Today, the fire of 2025 meets the unyielding code of 2026: Shib Owes You (SOU) launches as Shiba Inu’s on-chain NFT, turning every unfulfilled bridge claim into permanent, verifiable proof that the victims of the Shibarium Bridge exploit can own and trade. Audited by Hexens, SOU delivers what the community has always deserved: truth etched in Ethereum, while creating permanent, verifiable proof that users can hold, sell, or redeem.

The transfer hung in digital space, neither here nor there.

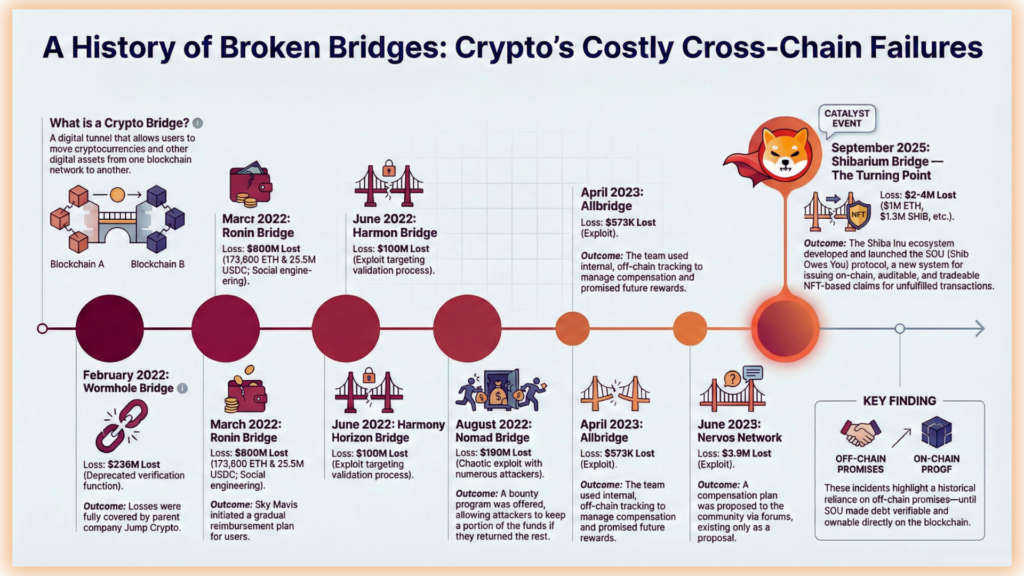

September 2025 brought the scenаrio every cross-chain user dreads. The Shibarium bridge, the vital connector between the Layer-2 network and Ethereum, fell to an exploit. The breach drained between $2 million and $4 million across 17 different tokens. Incident reports from the Shiba Inu development team identified the wreckage: $1 million in ETH, $1.3 million in SHIB, and missing balances of LEASH, ROAR, and TREAT.

A familiar sequence followed. Operations halted. Emergency procedures activated. Users checked wallets only to find transactions stuck in a digital void. One chain confirmed the departure. The other never recorded the arrival.

The industry has seen this movie before.

In March 2022, social engineering attacks compromised the Ronin bridge validators. The heist drained 173,600 ETH and 25.5 million USDC. Academic research published by arXiv in January 2025 documented the $600 million loss. That same year, the Wormhole bridge lost $236 million through a deprecated verification function. The Nomad bridge saw $190 million disappear in August 2022. The Harmony Horizon bridge lost $100 million in June 2022.

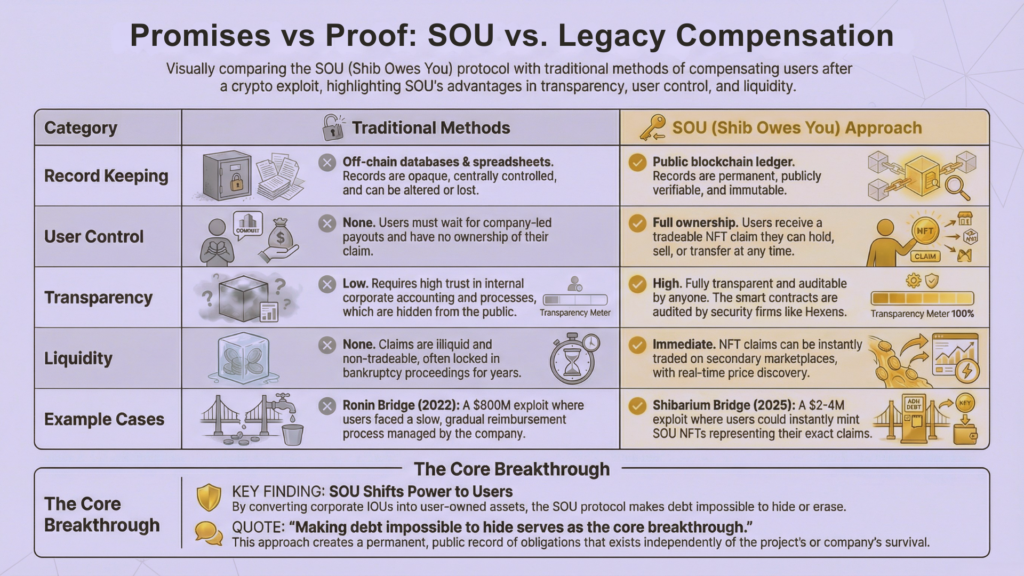

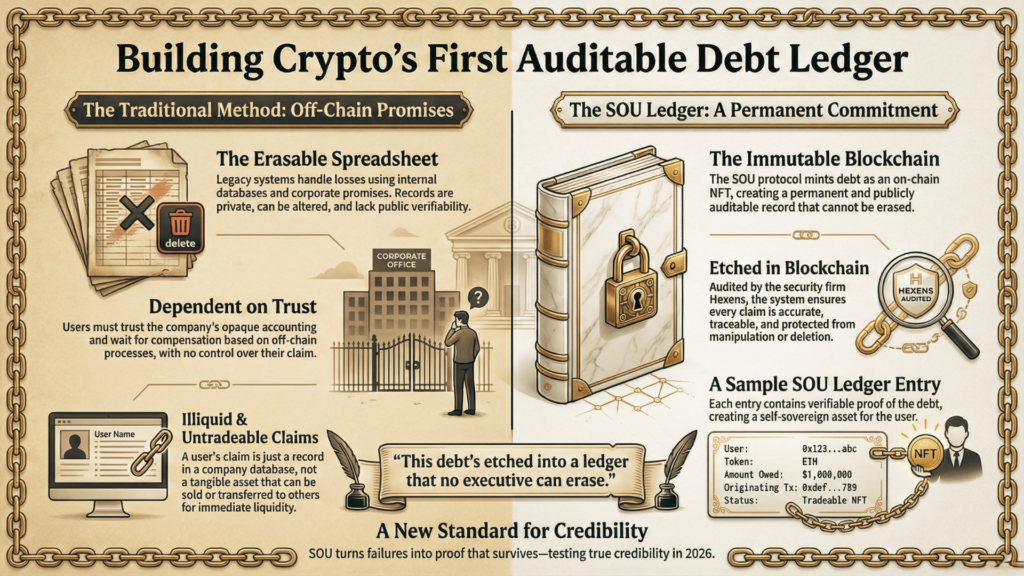

Corporate responses varied across these crises. Jump Crypto covered the Wormhole losses with its own capital. Sky Mavis worked toward gradual reimbursement for Ronin users. Nomad offered a bounty allowing attackers to keep a portion of the stolen funds. Most strategies relied on internal databases and corporate promises. The records lived in off-chain spreadsheets.

The Shiba Inu ecosystem built something different.

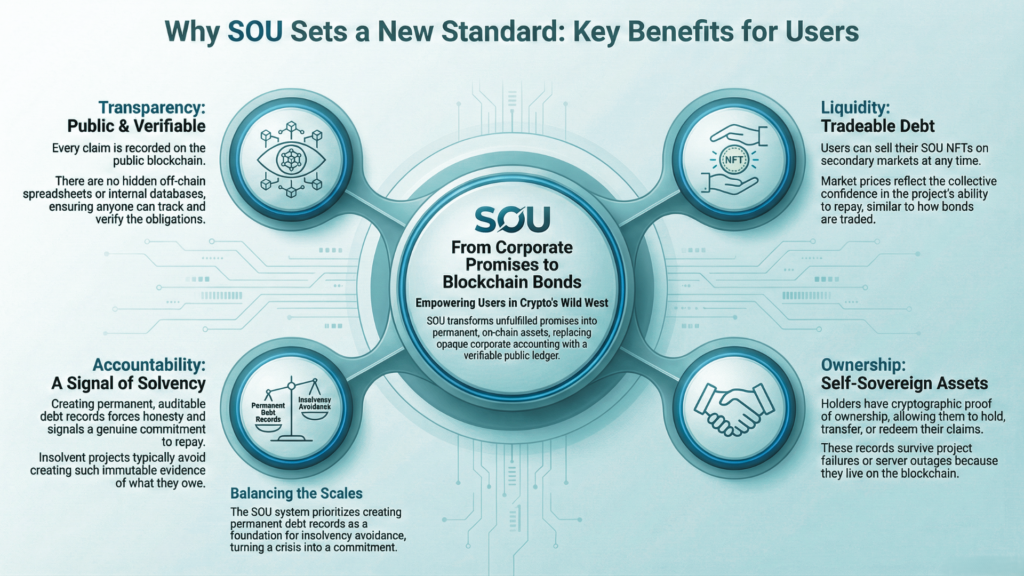

The SOU (Shib Owes You) system operates on the logic of a government treasury bond. When a country borrows money, it issues physical or digital proof of the obligation. Bondholders own the debt. They can sell these instruments to others who believe the state will eventually pay. Market confidence dictates the price. No one needs to trust internal government accounting because the bonds serve as the evidence.

The SOU protocol applies this logic to cross-chain situations. When a transfer fails due to liquidity shortfalls, the official SOU dashboard presents the choice. Users can accept an SOU NFT representing the unfulfilled claim or decline the transaction entirely. Accepting the claim triggers the protocol to mint or update a digital receipt recording the exact principal amount. To finalize the claim, users burn their Shibarium tokens using the dashboard’s “Claim SOU” button. This keeps the process secure, on-chain, and fully auditable.

If the same user bridges additional tokens of the same type and liquidity remains unavailable, the existing SOU updates its balance. One continuously maintained record exists per user per token type. Only verified contracts can trigger updates. Each SOU maintains a verifiable link to its originating transaction. A chain of custody survives every transfer or merge.

Related: SHIB 2025: The Year the Pack Refused to Break

Hexens audited the contracts. The firm verified the minting logic and confirmed protection against duplicate issuаnce. The audit ensures the principal calculations remain accurate and traceable.

Crypto has attempted compensation before, but never quite like this.

Previous compensation attempts lacked crуptographic finality. When Allbridge suffered a $573,000 exploit in April 2023, the protocol used internal tracking. Users waited while the team managed off-chain processes and promised future rewards.

Nervos Network proposed a similar framework for a $3.9 million exploit in June 2025. The compensation existed only in proposal form within community forums.

Legacy corporate systems demand absolute trust. Users lack cryptographic proof of their claims in these environments. Opaque accounting offers no transferable assets. Internal databases prevent the public from tracking repayment progress.

SOU replaces trust with ownership. Each NFT carries full ownership rights. Holders transfer their claims on supported marketplaces. They can sell the debt if immediate liquidity matters more than waiting for a payout. Real-time price discovery happens based on market expectations of the repayment timeline. Buyers purchase cryptographic proof of claim. The principal remains verifiable. Payout mechanisms stay transparent.

Related: Shiba Inu Suit-and-Tie Era Happening Now

The SOU framework delivers “accountability through transparency.” Every user tracks and verifies their claim directly on the blockchain. There are no off-chain databases or internal spreadsheets. You don’t have to trust corporate accounting because the proof’s on the public ledger.

Centralized custody models typically handle user losses through internal account credits or positions in opaque bankruptcy proceedings. These internal databases hide the records of what an exchange owes and remain inaccessible to independent verification. The SOU model turns every claim intо a self-sovereign asset. Users don’t depend on servers staying online or databases remaining intact. The blockchain itself maintains the records across thousands of nodes.

Secondary markets create immediate liquidity for debt. Traditional debt claims in bankruptcy proceedings often take years to resolve. These claims are usually impossible to trade freely. SOU holders who need cash list their NFTs on marketplaces. Real-time price discovery happens based on market expectations of repayment timelines.

Buyers purchase cryptographic proof of claim. Thе principal remains verifiable. Payout mechanisms stay transparent. Risk calculations’re conсrete. This shift forces a standard of honesty that legacy financial institutions can’t match.

The Shiba Inu ecosystem spent 2025 hitting the limits of trust. Legacy contracts revealed hidden mechanisms during the LEASH rebase. Governance flaws surfaced when the bridge fell to an exploit. SOU Protocol anchors its response in the same foundation that initially failed: smart contracts and the immutability of the blockchain. Deliberate design replaces the mess of inherited complexity. Hexens verified the code through an audit that found no hidden doors.

No one expects the system to stop every future failure. The objective involves changing the aftermath. The broader crypto industry’ll watch this implementatiоn closely. A successful SOU model establishes a template for handling accountability without a central authority. Solvency’s hard to prove, and if the system struggles, it’ll show that transparency’s a poor substitute for cash on hand.

Making debt impossible to hide serves as the core breakthrough. Every unfulfilled claim now sits in the unblinking eye of the public. This debt’s etched into a ledger that no executive can erase. No internal database can hide the figures. Recording the promise was the easy part. The real test involves whether these records translate into actual redemption.

In September 2025, the bridge broke. By early 2026, the ecosystem had built a debt ledger that survives even if companies fold or projects fail. It’s something no one had built befоre. On-chain accountability faces its first major field test. This permanence defines the ecosystem’s credibility. It also sets the bar for the rest of the industry.

The fire that refused to die in 2025 now burns under the cold scrutiny of code. SOU doesn’t ask for trust. It offers proof.

| Disclaimer Shiba Inu is not legally obligated to provide reimbursement or restitution for losses related to prior bridge transfers or related incidents. The SOU NFT initiative is offered as a voluntary, good-faith effort intended to support affected users and does not create any contractual, statutory, or fiduciary obligation to compensate participants or guarantee recovery of funds. Users remain responsible for determining eligibility, completing any claim process, and securely managing the custody, transfer, and ownership of their SOU NFTs and associated wallets or private keys.To the fullest extent permitted by applicable law, Shiba Inu and related contributors disclaim liability for losses, unsuccessful claims, user error, technical issues, or security incidents connected to participation in the claim process or subsequent handling of the NFTs. Participation signifies acknowledgment of these responsibilities and risks. |

Yona brings a decade of experience covering gaming, tech, and blockchain news. As one of the few women in crypto journalism, her mission is to demystify complex technical subjects for a wider audience. Her work blends professional insight with engaging narratives, aiming to educate and entertain.

You cannot copy content of this page