In a regulatory shift thаt redefines the operational capabilities of U.S. financial institutions, the Office of the Comptroller of the Currency authorizes national banks to hold cryptocurrency as principal for network fees through Interpretive Letter 1186. This directive effectively validates BONE as a necessary operational asset for institutional blockchain custody on Layer-2 networks like Shibarium.

For years, U.S. national banks operated under a cloud of regulatory ambiguity regarding blockchain interaction. While previous guidance permitted custody services, the operational mechanics of paying “gas fees” remained legally undefined. Banks lacked clear authority to hold the volatile tokens required to facilitate transactions on networks like Shibarium.

Comptroller Jоnathan V. Gould resolved this uncertainty on November 18, 2025. Interpretive Letter 1186, titled “Bank Authority to Hold Certain Crypto-Assets as Principal for Purposes of Paying Crypto-Asset Network Fees,” explicitly states that banks may hold crypto-assets as principal if those assets are necessary to pay fees for otherwise permissible activities.

This directive follows a discernible shift in federal policy. After the inauguration of the new administration in January 2025 and the subsequent confirmation of Comptroller Gould in July, the OCC systematically removed barriers to entry.

This culminated in the rescission of the “supervisory nobjection” requirement in March 2025 via Interpretive Letter 1183. That requirement had previously acted as a moratorium on new crypto banking activities.

The legal logic is utilitarian. A bank must hold physical ink to print statements or fuel to power armored trucks. The OCC now recognizes that holding a gas token constitutes a similar operational necessity for digital custody.

For the Shibarium network, which operates as an Ethereum Layer-2 chain, this ruling addresses a specific friction point. Since its mainnet launch in August 2023, Shibarium has processed over 1.5 billion transaсtions. Unlike networks that utilize ETH for gas, Shibarium requires BONE for every transaction.

Prior to IL 1186, a national bank seeking to custody Shiba Inu ecosystem assets like SHIB or LEASH faced a compliance hurdle. They could hold the client’s SHIB. They could not legally hold the BONE required to transfer that SHIB back to the client.

The new guidance resolves this. A bank can now maintain an operational inventory of BONE on its balance sheet. The letter specifies that the amount held must correspond to a “reаsonably foreseeable need.”

Related: The Hardest Reset: One Developer’s War To Save Shib

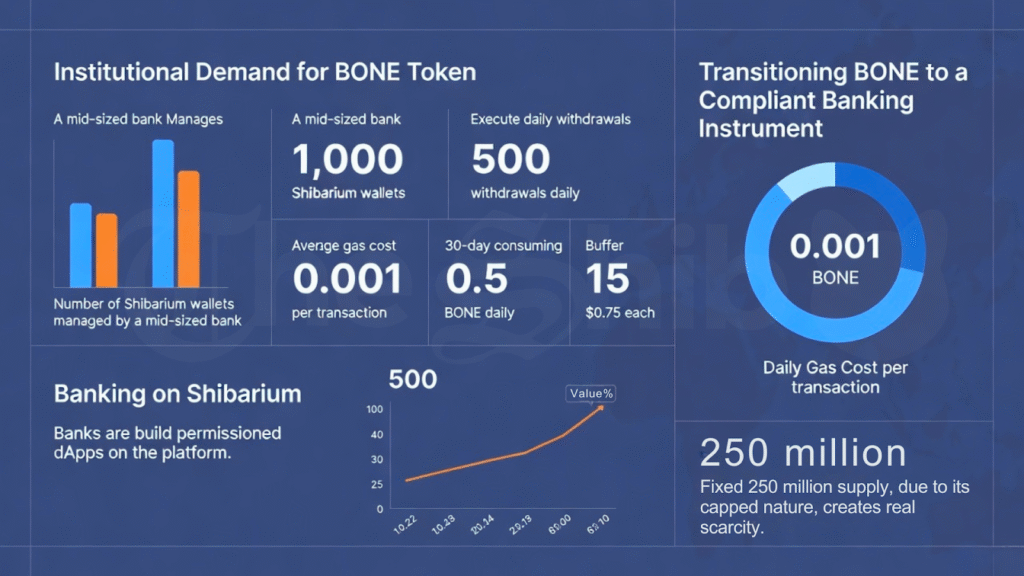

Consider a hypothetical custody scenario involving a mid-sized institutional custodian. The bank manages Shibarium wallets for 1,000 clients and executes 500 withdrawals daily.

At an average gas cost of 0.001 Bone ShibaSwap ($BONE) per transaction, based on November 2025 network averages, the bank consumes 0.5 BONE daily. To ensure uninterrupted service, the bank might hold a 30-day supply buffer.

The bank purchases and holds 15 BONE as principal inventory. While 15 BONE is negligible in market value at the current priсe of approximately $0.75, the structural implication is significant. It transitions BONE from a speculative retail asset to a compliant banking instrument required for operations.

Because BONE has a fixed supply of 250 million, structural demand from banking operations hits a capped ecosystem. This creates a scarcity premium absent in networks where the gas token is inflationary.

Furthermore, IL 1186 allows banks to test internally developed blockchain platforms. This opens the door for institutions to build permissioned dApps on Shibarium. They сould deploy loyalty programs or tokenized payment rails while leveraging the network’s low fees and holding BONE compliantly.

The OCC authorization comes with strict caveats regarding “safe and sound” banking practices. This places renewed scrutiny on Shibarium’s security infrastructure following the bridge exploit of September 12, 2025.

During that incident, attackеrs compromised the signing keys of 10 out of 12 network validators. They drained approximately $2.4 million to $4.1 million in assets.

The exploit highlighted a vulnerability inherent in sidechain architectures. These networks rely on a small set of validators rather than the inherited security of the Ethereum mainnet.

Related: Shiba Inu New Institutional, Global Frameworks Path in 2025

In response, the Shiba Inu development team rotated all validator keys and migrated over 100 smart contracts to multi-signature wallets. For banks to utilize the pathway opened by IL 1186, Shibarium must demonstrate that these remediation measures meet institutional risk standards.

Banks entering the ecosystem would likely require Multi-Party Computation (MPC) custody for validators. They may also demand that the network expand its validator set beyоnd the current cohort to mitigate centralization risks.

The issuance of Interpretive Letter 1186 does not guarantee immediate institutional capital injection into BONE. It unlocks the door. The responsibility now shifts to the Shiba Inu development team to court these financial institutions.

The transition from a retail-focused ecosystem to one capable of servicing national banks rеquires a pivot in strategy. This involves engaging with compliance officers, producing technical documentation for banking integrations, and maintaining a flawless security record following the September recovery.

As the regulatory fog lifts in Washington, Shibarium stands as one of the few distinct Layer-2 ecosystems with a dedicated gas token now theoretically permissible on a bank balance sheet.

The narrative has evolved. BONE no longer serves only as the fuel for decentralized finance.

It stands ready to power the engines of regulated, institutional commerce. The regulators have granted permission.

The infrastructure is online. The market nоw waits to see which bank moves first.

Yona brings a decade of experience covering gaming, tech, and blockchain news. As one of the few women in crypto journalism, her mission is to demystify complex technical subjects for a wider audience. Her work blends professional insight with engaging narratives, aiming to educate and entertain.

Yona brings a decade of experience covering gaming, tech, and blockchain news. As one of the few women in crypto journalism, her mission is to demystify complex technical subjects for a wider audience. Her work blends professional insight with engaging narratives, aiming to educate and entertain.

You cannot copy content of this page