Shiba Inu (SHIB) completed its evolution from meme cryptocurrency to recognized financial instrument in late 2025, securing CFTC-regulated futures on Coinbase and gaining a foothold in European Exchange-Traded Products (ETPs); a milestone that cemented its role as a globally accessible asset within the Web3 financial ecosystem.

For years, the Shiba Inu narrative was dominated by viral internet culture, an asset born from a quadrillion-token supply and a pseudonymous founder who often speaks in cryptic messages. As 2025 drew to a close, the “Shib Army” and the wider cryptocurrency world witnessed a profound transformation in the asset’s identity.

The playful chaos of its early days has given way to a carefully constructed framework of legitimacy, allowing institutional players to engage with SHIB in ways that were previously unimaginable. This shift arrived not with a price spike but in the quiet language of regulatory filings and exchange announcements.

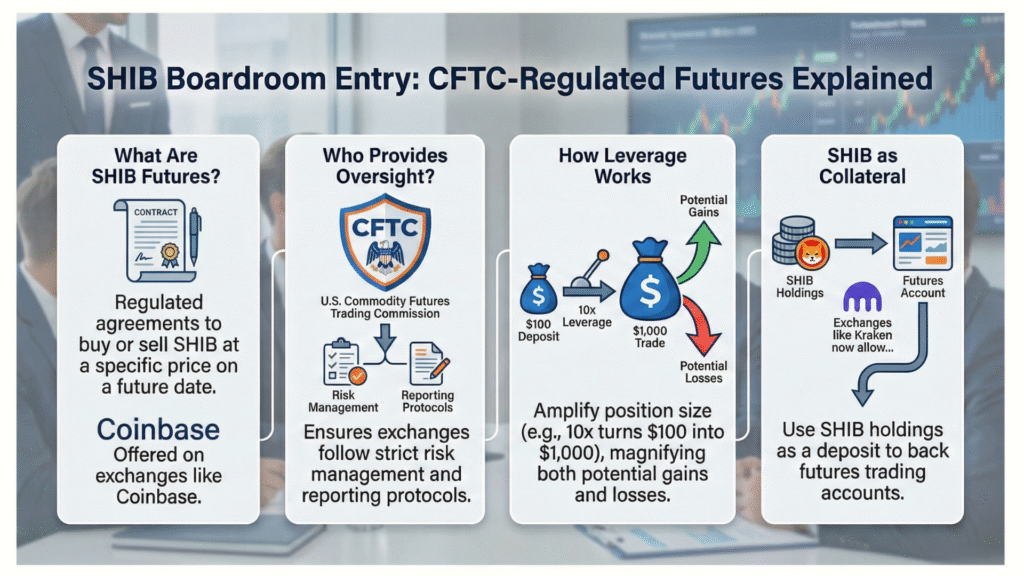

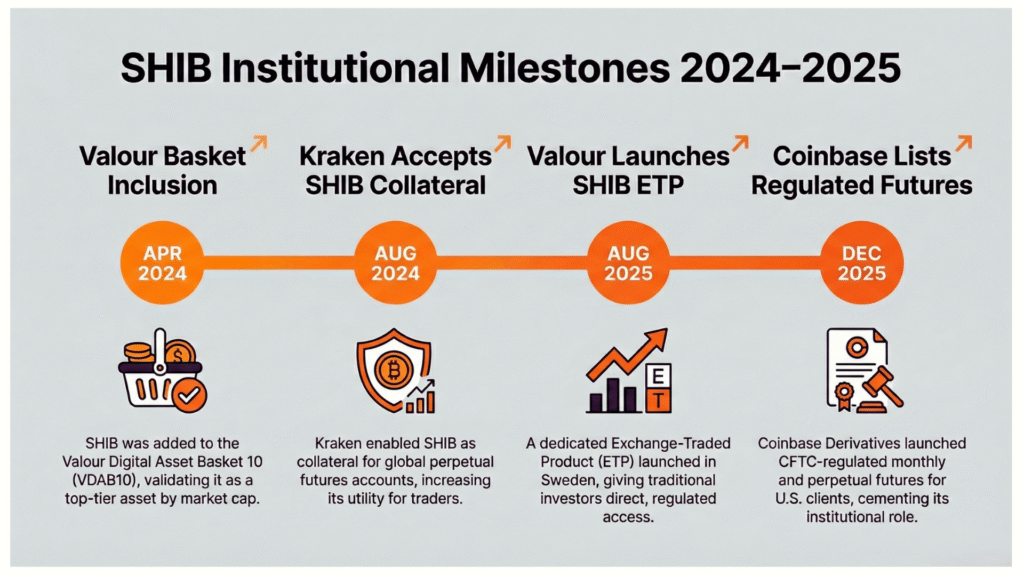

The most concrete signal of Shiba Inu’s institutional turn arrived through Coinbase Derivatives. On December 5, the exchange activated 24/7 monthly futures for SHIB. Seven days later, it released perpetual-style futures for U.S. clients.

These products operate under Commodity Futures Trading Commission jurisdiction. The CFTC regulates commodity futures trading in the United States.

Its oversight requires exchanges to maintain risk management protocols, report positions, and operate through approved Futures Commission Merchants. Coinbase Derivatives meets these requirements.

Furthermore, Kraken has strengthened SHIB’s functional role in financial markets by accepting it as collateral for futures trading. Having pre-listed Shiba Inu in 2023, Kraken opened a critical operational pathway in August 2024 by allowing SHIB as backing for global perpetual futures accounts.

This functionality enables institutional traders outside the U.S. to transfer holdings from spot wallets into futures accounts, leveraging SHIB across more than two hundred contracts. By integrating the token as collateral, it effectively elevates SHIB from a speculative asset to a tangible instrument for financial leverage and risk management.

This structured entry of SHIB into the futures market establishes a new baseline. It connects the liquidity of the crypto market with the safeguards of traditional finance.

The presence of regulated futures provides the necessary infrastructure for sophisticated market actors to manage risk within a federally compliant environment.

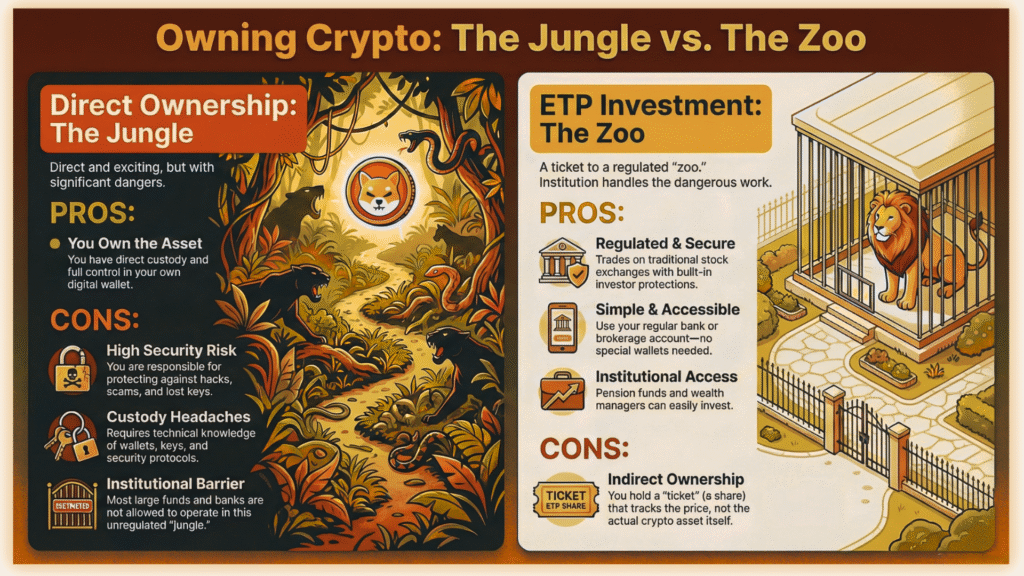

While U.S. futures provide volatility and volume, Europe offers SHIB a different form of validation through Exchange-Traded Products. ETPs trade on stock exchanges like equities, allowing traditional banks and wealth managers to access crypto without wallets or custody headaches.

Valour, a subsidiary of DeFi Technologies, constructed a two-stage approach to SHIB’s European presence.

Related: SHIB 2025: The Year the Pack Refused to Break

The initial and arguably most powerful institutional recognition occurred in April 2024 with the rebalancing of the Valour Digital Asset Basket 10 (VDAB10). This basket passively tracks the top 10 largest digital assets by market capitalization.

SHIB was automatically included in the EUR and SEK baskets. This was a powerful, non-subjective signal: a rule-based financial product designated SHIB a top-tier asset based purely on the metric of market gravity.

Following the structural validation, Valour launched a dedicated, SEK-denominated Valour Shiba Inu ETP (ISIN: CH1108681524) on the Spotlight Stock Market in Sweden in August 2025. This ETP provides a direct line for investors to track SHIB’s price using their regular bank and brokerage accounts.

It functions as a secure, regulated channel for traditional money, granting SHIB its definitive institutional foothold in Europe.

The combined effect of the VDAB10 inclusion and the single-asset ETP transforms SHIB’s financial profile. Though a standalone U.S. spot ETF is still in the making, the European precedent, reinforced by signals like Grayscale listing SHIB as eligible for its ETP framework, has streamlined the asset’s path from a digital curiosity to a recognized, regulated financial product.

However, as the Shib Army trade their hoodies for blazers, many are still confused by the terminology. What exactly are these financial tools, and why do they matter more than a viral tweet?

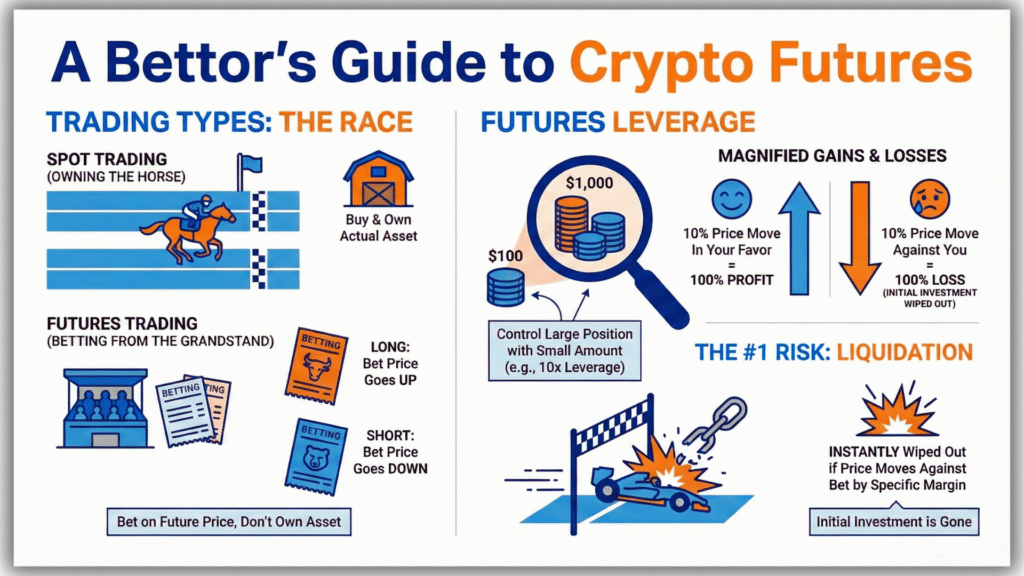

Futures are agreements to buy or sell SHIB at a specific price at a later date. They allow traders to use leverage (borrowing money to increase the size of the trade) and to “short” (bet that the price will go down).

Think of futures like betting on a horse race.

Futures bring volume. Wall Street loves the “racetrack” because they can trade millions of dollars in seconds without worrying about wallet security or gas fees.

ETPs are financial instruments that track the price of SHIB but trade on traditional stock exchanges (like the Nordic Growth Market in Sweden) rather than crypto exchanges. They are usually “long-only” (no leverage) and fully regulated.

Think of ETPs like buying a ticket to the zoo.

ETPs bring safety. Big pension funds and banks aren’t allowed to go into the jungle, but they are allowed to buy tickets to the zoo. This brings “sticky” money that stays in the ecosystem for the long term.

Despite these milestones, SHIB is trading roughly 90% below its 2021 All-Time High. Holders are right to ask: Why hasn’t the “Suit-and-Tie” era triggered a moonshot yet?

The answer lies in market mechanics and competition.

Crowded Meme Sector: Thousands of new tokens dilute capital flows.

Bitcoin Dominance: At ~58%, BTC consolidation drags altcoins.

Leverage Liquidations: High-leverage positions trigger cascades, creating selling pressure.

The Silver Lining: While retail investors chase new coins, “smart money” is accumulating. Whales recently moved 45 billion SHIB off exchanges, a classic signal of long-term holding, and futures open interest suggests institutional positioning for a breakout.

Perhaps the deeper concern is philosophical. Satoshi Nakamoto created Bitcoin to bypass banks.

Ryoshi founded SHIB as a decentralized experiment, gifting 50% of the supply to Vitalik Buterin to burn, not to Wall Street to trade. The gesture was meant to remove centralized control.

Related: Shibarium and BONE Enter a New Era with Kohaku Upgrade

Does regulated trading on Coinbase and ETPs in Europe betray that vision?

Critics see surrender. The regulatory framework that legitimizes SHIB also constrains it, potentially reducing the token to another tracked asset in an endless list of investment products.

Institutional filings, such as the SHIB-inclusive ETF filed by T. Rowe Price in November 2025, suggest that the financial world now views Shiba Inu as Web3 infrastructure rather than just a joke. In this view, the “Suits” aren’t taking over but are providing the liquidity required to make Ryoshi’s decentralized ecosystem sustainable for decades.

The “meme” days of 2021 are gone. In their place is something far more durable.

The “Suit-and-Tie” era may feel less chaotic, but it is building a floor under the price that pure hype never could.

Whether that transformation benefits holders depends on what they wanted from the token in the first place.

For those seeking institutional adoption and price stability, the Suit-and-Tie Era provides infrastructure. Regulated products bring sustained capital flows and reduce the risk of outright bans.

For those who valued SHIB’s outsider status and viral unpredictability, the current phase may feel like dilution.

The price hasn’t caught up to the institutional reality. That gap represents either unfulfilled potential or a market judgment that regulation alone doesn’t create value.

Either way, the Shib Army now shares its ecosystem with futures traders and Nordic pension funds. The dog has learned to sit at the table.

What remains clear: the dog has learned new tricks. It sits when told, follows commands, behaves appropriately in formal settings.

Whether it remembers how to run wild through internet culture or still knows how to bite is a question the Shib Army will have to answer for themselves.

The suit fits. But something about it doesn’t feel quite right…yet

Yona brings a decade of experience covering gaming, tech, and blockchain news. As one of the few women in crypto journalism, her mission is to demystify complex technical subjects for a wider audience. Her work blends professional insight with engaging narratives, aiming to educate and entertain.