On the morning of December 5, somewhere in the world, two fingers peeled back two silver holograms on Casascius coins that had stayed untouched since the Obama administration. In that instant, two thousand bitcoin (worth $180 million today) left the brass relics and slipped into new digital wallets. Fourteen years after the U.S. government killed the only mint that ever made physical bitcoin, the rarest Casascius coins of 2025 are waking up.

Mike Caldwell, a soft-spoken software engineer, spent his evenings on BitcoinTalk forums arguing with strangers about whether invisible money could ever feel trustworthy. His answer was simple: make it physical.

He ordered blank brass planchets from a company that normally produced car-wash tokens, set up a laser etcher in his garage, and began pressing the Bitcoin “₿” symbol into metal. Under a tamper-evident hologram he tucked a slip of paper bearing a real private key.

He named the project Casascius, an acronym for “Call A Spade A Spade In Coin Usage.” Between late 2011 and November 2013 he produced exactly 27,912 loaded coins and bars.

The rarest pieces: six gold-plated 1,000-BTC bars and sixteen 1,000-BTC coins.

Buyers wired him the current bitcoin price plus twenty to fifty dollars for materials and postage.

Identity verification was not requested, nor were any registration forms required. The paid-for asset was discreetly shipped via standard postal service, often arriving in a plain envelope within the week.

Related: Shiba Inu Delivers on Its Promise With New Bounty Contract

On November 15, 2013, a letter arrived from the U.S. Financial Crimes Enforcement Network. The agency informed Caldwell that embedding spendable bitcoin in physical objects turned him into an unlicensed money transmitter.

Twelve days later, on November 27, he posted a short notice on his website and stopped loading new coins forever. From that moment, every Casascius coin became a fixed, finite artifact; the only physical Bitcoin the world would ever see.

Two independent trackers update the count in real time:

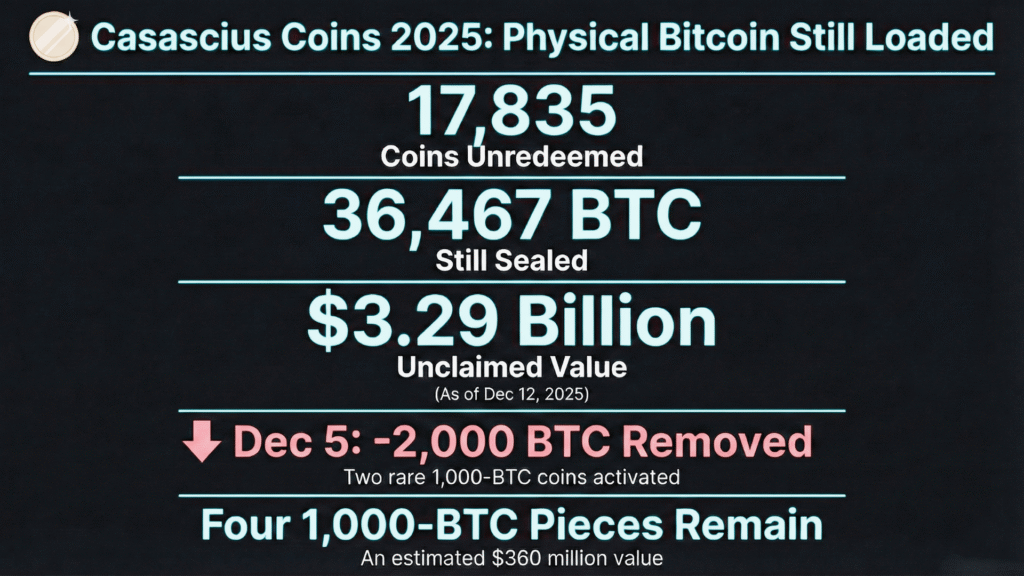

The two 1,000-BTC coins that activated on December 5 removed 2,000 BTC from those totals, the single largest Casascius movement ever recorded.

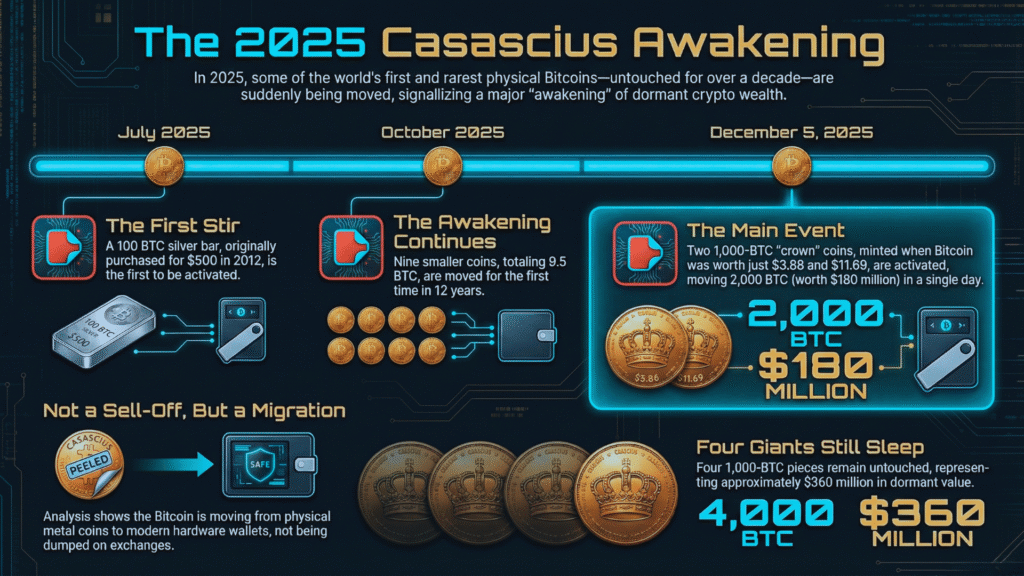

The pattern began in July when a holder known online as “John Galt” peeled a 100-BTC silver bar he bought for $500 in 2012. October saw nine smaller coins stir after twelve years of silence.

Then, on December 5, the two crown jewels, one minted when bitcoin was $3.88, the other when it was $11.69, transferred cleanly to modern multi-signature wallets. On-chain analysts saw no rush to exchanges.

Related: The Mythmakers: How Satoshi Nakamoto Became America’s New Conspiracy Icon

The Bitcoin simply moved from metal to hardware, the quiet signature of early believers finally deciding that a desk drawer was no longer the safest vault on earth.

Even after the Bitcoin is spent, the metal retains value. A peeled 25-BTC coin graded by PCGS fetched $1.69 million at Heritage Auctions in 2021 because collectors wanted the relic itself.

Unloaded blanks trade on eBay for hundreds of dollars; pristine loaded examples almost never appear publicly.

Four 1,000-BTC pieces remain untouched. That is four billion dollars in brass and gold-plated metal still waiting under unbroken holograms.

Somewhere tonight, someone is holding one of those coins, feeling its weight, and thinking whether fourteen years was long enough.

Yona brings a decade of experience covering gaming, tech, and blockchain news. As one of the few women in crypto journalism, her mission is to demystify complex technical subjects for a wider audience. Her work blends professional insight with engaging narratives, aiming to educate and entertain.