The Crypto Report 2025 begins not with a price chart or market prediction, but with a pattern. The kind that emerges only when the noise fades, the rhythm of innovation, consolidation, and quiet resilience running beneath the chaos of price swings and political rhetoric. If 2024 was the year of recalibration, then 2025 has become the year of rediscovery, of what crypto was meant to be, and what it’s inevitably becoming.

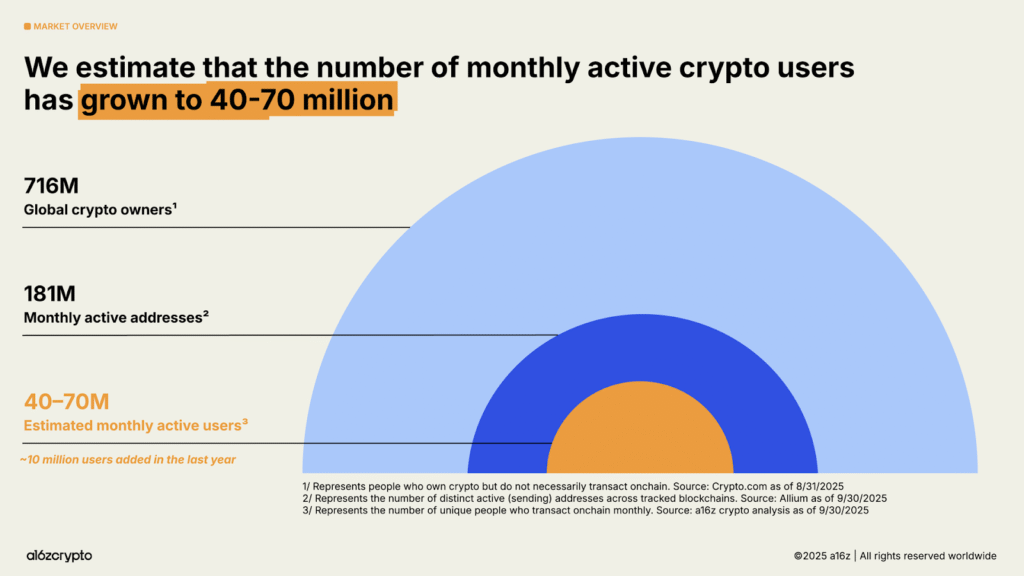

The State of Crypto 2025 places total crypto market capitalization above four trillion dollars, marking one of the largest growth years since 2021. Active crypto users reached seventy million, up from sixty million last year, while the broader population of holders rose sixteen percent to 716 million.

Mobile-wallet activity increased fastest in emerging markets. Argentina recorded a sixteen-fold rise in wallet use over three years amid currency instability. Meanwhile, trading interest remained strong in developed markets such as Australia and South Korea.

The report attributes the surge to maturing networks that now sustain real economic activity. Hyperliquid and Solana together generate fifty-three percent of blockchain revenue, while aggregate throughput across major chains reached 3,400 transactions per second, over one hundred times higher than five years ago.

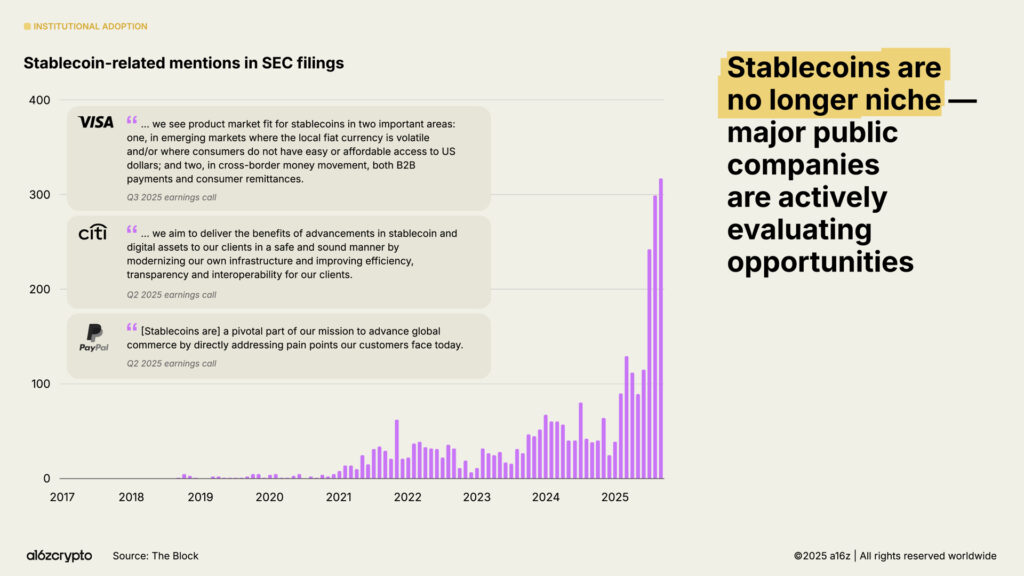

Institutional participation features prominently in State of Crypto 2025. Traditional finance firms including Visa, BlackRock, JPMorgan Chase, and Fidelity launched or expanded digital-asset services.

Bitcoin and Ethereum exchange-traded products collectively hold 175 billion dollars, up 169 percent from 65 billion a year earlier (Matsuoka et al., 2025). BlackRock’s iShares Bitcoin Trust remains the highest-volume Bitcoin ETP launch to date. Institutional treasuries now control roughly ten percent of Bitcoin and Ethereum supply when ETP and corporate holdings are combined.

The report also notes legislative catalysts such as the GENIUS Act, which is cited as improving clarity for stablecoins and token issuers.

Related: 2025: The Year of the Industrialized Heist

Stablecoins processed forty-six trillion dollars in transactions during 2025, a 106 percent increase from the prior year. Adjusted for activity filters, true economic volume reached nine trillion dollars, with 1.25 trillion handled in September 2025 alone.

Total stablecoin supply surpassed three hundred billion dollars, led by USDT and USDC, which make up eighty-seven percent of circulation. Ethereum and Tron accounted for nearly two-thirds of all settlements.

Over one percent of all U.S. dollars now exist as tokenized stablecoins, collectively holding more than 150 billion dollars in U.S. Treasuries, ranking stablecoin issuers among the top twenty holders of U.S. government debt.

The Crypto Report 2025 identifies five core metrics of maturity: mobile-wallet users, adjusted stablecoin volume, ETP flows, DEX-to-CEX trade ratio, and transaction-fee demand (Matsuoka et al., 2025). Mobile-wallet users reached 35 million early in 2025, while average Ethereum Layer 2 fees fell below one cent—down from twenty-four dollars in 2021.

Solana’s network generated three billion dollars in annual revenue, and builder participation rose seventy-eight percent in two years (Matsuoka et al., 2025). Cross-chain bridges like LayerZero and Circle CCTP are now key interoperability layers, processing tens of billions in volume. Hyperliquid’s canonical bridge alone handled seventy-four billion dollars this year.

Zero-knowledge privacy adoption is growing. Railgun’s monthly flows exceeded two hundred million dollars, and Zcash’s shielded supply reached four million ZEC.

Related: Shiba Inu and the Rise of the Powerful Consumer Crypto Economy

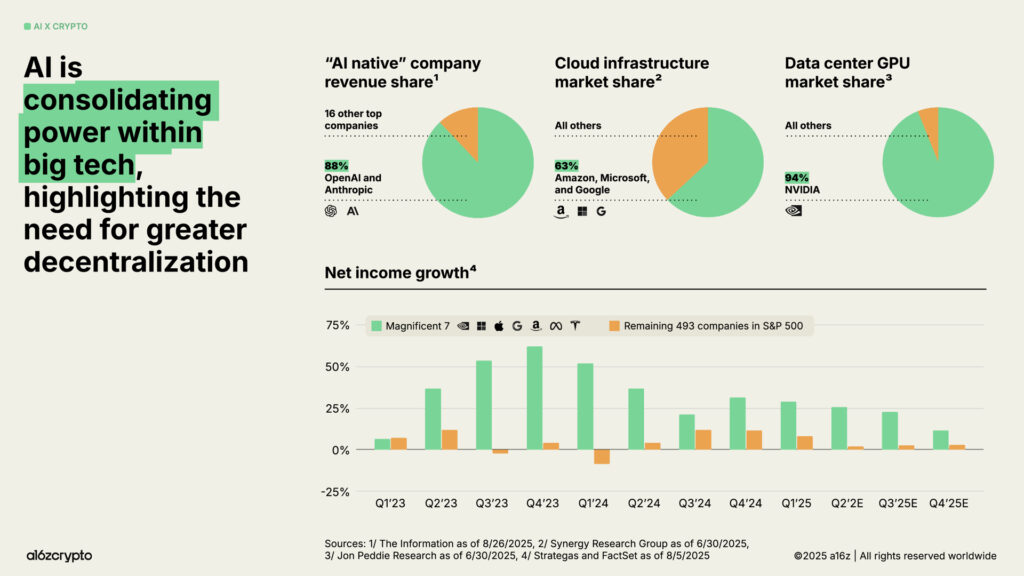

The report highlights the intersection of blockchain and AI systems. World ID (formerly WorldCoin) has verified over seventeen million users for “proof-of-humanity.” Emerging standards such as x402 aim to enable agent-to-agent micro-payments in what Gartner projects could be a thirty-trillion-dollar “machine economy” by 2030.

Centralization remains a challenge. OpenAI and Anthropic hold eighty-eight percent of AI-native revenue. Amazon, Microsoft, and Google control sixty-three percent of cloud infrastructure, and NVIDIA supplies ninety-four percent of data-center GPUs. The authors argue blockchain could counterbalance these concentrations through verifiable, decentralized compute.

The State of Crypto 2025 concludes that the prerequisites for crypto mainstream adoption, scalable networks, regulation, institutional access, and stablecoin rails, are now in place. The next phase will depend on integrating these components into consumer products that make blockchain activity invisible to users.

Stablecoin supply could grow tenfold to three trillion dollars by 2030 if these conditions persist. Token-generating networks are shifting value creation from speculation to usage-based revenue.

According to Crypto Report 2025, the industry has entered its period of structural maturity. Market data show trillions in volume, expanding institutional presence, and sustained developer growth. Whether crypto can now cross the threshold from financial infrastructure to daily-life utility remains to be proven.

Yet the evidence of crypto mainstream adoption, visible in onchain data, stablecoin usage, and institutional entry, suggests that transition is already underway.

The Crypto Report 2025 invites a deeper question: if the systems are finally ready, can society keep pace? The next frontier will not be about technology alone, but about trust, transparency and how blockchain becomes part of daily life without users even noticing.

Yona brings a decade of experience covering gaming, tech, and blockchain news. As one of the few women in crypto journalism, her mission is to demystify complex technical subjects for a wider audience. Her work blends professional insight with engaging narratives, aiming to educate and entertain.