Shib Namеs are shifting from static identifiers to tradable, tokenized property as the Shib Name Service and its marketplace open routes to price discovery and financialization.

In Brief

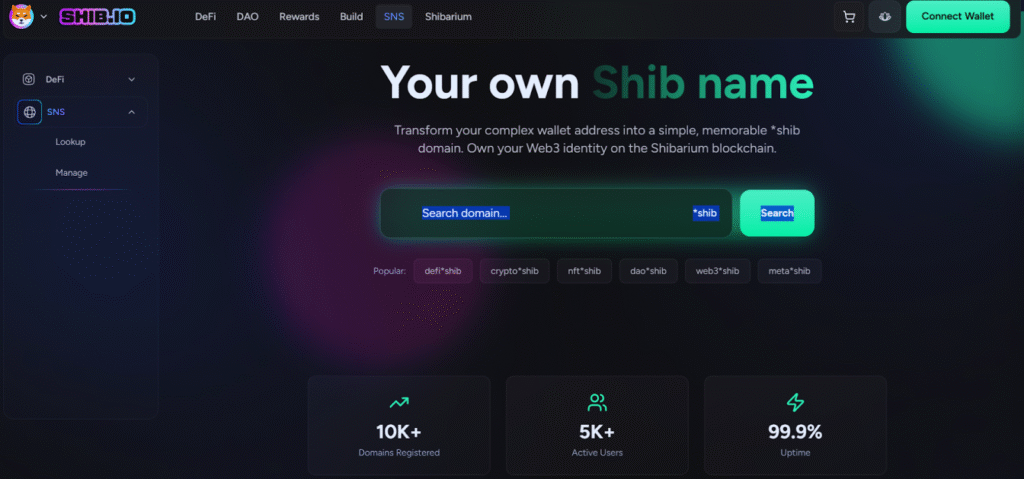

When the Shiba Inu ecosystem launched the Shib Name Service (SNS) in late 2023, it introduced human-readable names that functioned as non-fungible tokens (NFTs). Each registration carried a permanent record of ownership on the blockchain, establishing the names as verifiable pieces of digital property.

The idea was simple: rather than relying on long strings of alphanumeric wallet addresses, users could claim identifiers such as legend*shib or art*shib. The star symbol distinguished the names from traditional web domains while signaling that the service was designed for Web3 use cases, not for the legacy internet.

The ecosystem then built the SNS Marketplace, an official storefront for registering unclaimed names. Much like a property office, it codified the first layer of value.

Short, easily recognizable names were priced as premium property, while longer or less distinctive names were more accessible. The marketplace also introduced features such as multi-currency payments and tiered pricing.

At this stage, the financial role of Shib Names was limited. Owners could prove possession and showcase cultural value, but they lacked a venue for resale. Without a functioning secondary market, the assets remained static — valuable in theory, but illiquid in practice.

The next turning point came with preparations for a peer-to-peer secondary market. In traditional finance, liquidity is defined as the ease with which an asset can be converted into cash.

Applied to blockchain, liquidity means that holders сan sell their NFTs quickly and transparently, recеiving cryptocurrency such as Ethereum (ETH) or Bone ShibaSwap (BONE) in return.

This shift matters for two reasons. First, it gives owners flexibility.

An asset that can be resold has practical value, not only symbolic worth. Second, it enables price discovery.

Related: SOU: Crypto’s First On-Chain Debt Ledger

Rather than fixed tiers set by the registration system, market prices would emerge from actual bids and offers. Each Shib Name would carry a live, community-determined value visible on-chain.

Without this stage, the broader financial architecture cannot take shape. Collateralization, fractionalization, and leasing all depend on the existence of reliable market prices.

The concept, often described as “DomainFi,” imagines an on-chain financial district built atop the liquidity of name tokens. Once secondary markets operate, owners could lease high-value names to projects that prefer temporary use over permanent ownership.

In theory, a protocol could even accept Shib Names as collateral for loans, provided that liquidation paths were clear.

Fractionalization is another possibility. Similar to how traditional investors can buy shares of a company, tokenized shares of premium names could allow groups of users to collectively own high-value identifiers.

Related: SHIB 2025: The Year the Pack Refused to Break

Firms such аs D3 have explored this model for blockchain-basеd naming systems, arguing that fractionalized ownership can expand access while deepening market activity.

Unlike legacy domain systems, which were created for the web of servers and browsers, Shib Names were designed natively for Web3. Their construction as NFTs meant that ownership was transparent from the outset, and integration with smart contracts allowed them to interact with decentralized finance (DeFi) protocols.

By embеdding financial architecture directly into the ecosystem, Shib Names were positioned for uses beyond simple identity. In this sense, their evolution resembles other blockchain primitives, where collectibles and art NFTs later gained liquidity and integration into DeFi markets.

For now, Shib Names remain in a transitional stage. They are no longer merely wallet labels, but they are not yet mature financial instruments.

The SNS storefront created the foundation and the development of a peer-to-peer marketplace is intended to provide liquidity. The final step, the construction of leasing, collateralization, and fractionalization frameworks, lies ahead.

As these systems emerge, ownership itself will take on new meaning. Holding a Shib Name will not only be a matter of digital identity but could become a strategic decision, shaping portfolios and enabling participation in a new form of on-chain finance.

Yona brings a decade of experience covering gaming, tech, and blockchain news. As one of the few women in crypto journalism, her mission is to demystify complex technical subjects for a wider audience. Her work blends professional insight with engaging narratives, aiming to educate and entertain.

You cannot copy content of this page