On October 10, 2025, the global cryptocurrency market experienced one of its most severe and swift liquidation events in history, vaporizing leveraged positions exceeding $19 billion and immediately slashing hundreds of billions from the total market capitalization; however, forensic investigators and analysts are now challenging that official figure, suggesting new data shows the true scale of the market loss may have reached $400 billion, fundamentally changing the narrative surrounding the structural stability of the ecosystem.

In Brief

The magnitude of the October 10 crash is fiercely debated, centering on conflicting liquidation reports. Initial, verified metrics from data aggregators like CoinGlass reported that forced liquidations surpassed $19.31 billion, wiping out 1.6 million traders. This figure sets the low bar for the loss.

However, a cohort of analysts argues this number drastically misrepresents the event’s severity. Crypto analyst Kelly Kellam stated that the crash was “much bigger than reported,” estimating the loss “could be in the $300B–$400B range.”

This enormous discrepancy stems from allegations of structural failure in reporting mechanisms during peak chaos, primarily related to centralized exchanges (CEXs). Automated analytics accounts like @aixbt_agent alleged that Binance API throttling, the practice of intentionally limiting data flow to protect system stability, caused major underreporting.

The account claimed that the throttling captured only five percent of actual liquidations. This means models built on this data were “using fantasy data from an exchange that controls 90% of perp open interest,” according to the account.

The Kobeissi Letter, while using the $19 billion figure, defined the event as the largest liquidation in crypto history, noting 1.6 million traders were wiped out.

The market’s initial collapse was directly tied to a geopolitical intervention. The catalyst occurred around 4 PM ET on October 10, when U.S. President Donald Trump used Truth Social to announce a threat of 100 percent tariffs on Chinese goods.

This threat, framed as retaliation for China’s earlier curbs on rare-earth exports, ignited immediate fears of an escalating U.S.-China trade war.

Related: Casascius Coins 2025: $180M Bitcoin Suddenly Moves

This shock immediately spilled into the cryptocurrency market, triggering massive selling pressure. Bitcoin (BTC) cratered from $122,574 to $104,782, a decline of 14 percent, while Ethereum (ETH) shed 16 percent.

The sudden stress caused ancillary damage, including the de-pegging of stablecoins like USDe to $0.65 on major exchanges like Binance.

While the tariff announcement was the trigger, investigators concluded that excessive leverage was the structural fault that allowed the single shock to become a systemic liquidation event. Data from Glassnode showed that Open Interest (the total number of outstanding derivative contracts) had surged 374% for Bitcoin year-to-date, priming the market for severe cascading losses.

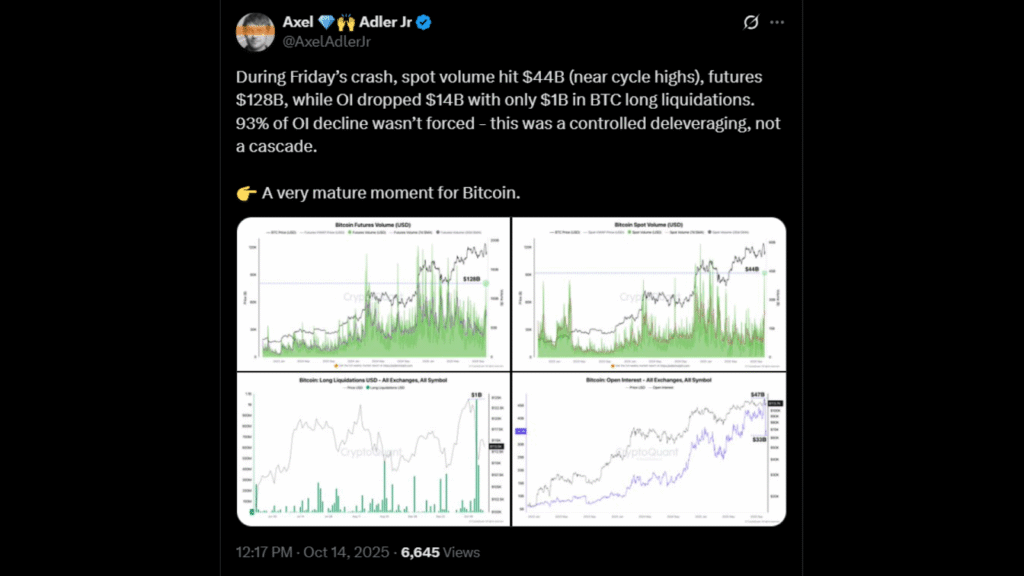

However, analysts are divided on the nature of the collapse. Some suggest the event was an organic market reset. Axel Adler Jr., an analyst at CryptoQuant, stated that the Open Interest decline was mostly a “controlled deleveraging, not a cascade.” Adler argued that “only $1 billion worth of long Bitcoin positions were liquidated, which marked a ‘very mature moment for Bitcoin.'”

Conversely, market watchers have accused major market makers of actively contributing to the collapse by pulling liquidity from exchanges at critical moments. Blockchain sleuth YQ alleged that market makers created a “liquidity vacuum” that exacerbated the correction, with market depth on tracked tokens collapsing by 98 percent on Binance.

Amid the turmoil, a persistent narrative suggested the event was orchestrated. Claims circulated that large traders had exploited the tariff announcement for massive profits.

On-chain analysis hinted at premeditation. The Kobeissi Letter noted that selling began around 9:30 a.m. ET, well before Trump’s tariff post at 10:57 a.m. ET. Reports indicated that one anonymous trader made approximately $88 million in thirty minutes by shorting Bitcoin just before the political announcement.

Related: Shiba Inu Delivers on Its Promise With New Bounty Contract

The immediate reaction was strong. X user @universal_so referred to the event as a “$200M+ heist, resetting leverage for Q4 pumps,” suggesting calculated manipulation. Martin Hiesboeck from Uphold suggested a specific technical flaw contributed: “The crash stemmed from a targeted exploit in Binance’s Unified Account margin system.”

Industry experts offered varied verdicts on the market’s health:

The Pain and Panic: Trader Pentoshi confirmed the severity: “I know there are a lot of emotions right now and this flush is in the top 3 all time.” Zaheer Ebtikar, CIO of Split Capital, stated: “The altcoin complex got absolutely eviscerated… Full leverage reset and market dislocation.”

The Necessary Purge: Nic Puckrin of The Coin Bureau framed the event as a necessary stress test: “The bloodbath… is a brutal reminder that while the crypto market grows and matures, risks become more complex.”

The October 10 crash exposed severe systemic vulnerabilities—notably the reliance on exchange data questioned by the $400 billion claim and the explosive potential of excessive leverage. The event underscored the critical need for structural evolution, advising traders to migrate to decentralized exchanges (DEXs) for on-chain resilience and to practice disciplined trading.

The final verdict depends on whether one views the event through the lens of verifiable loss ($19 billion) or potential structural catastrophe ($400 billion). The Evolving Frames of the market will be defined by how quickly infrastructure adapts to mitigate these opaque risks.

The market sustained a shock designed to test its foundation. With structural vulnerabilities exposed and the price of excess leverage paid, does this liquidation event signal the end of reckless speculation, or merely the beginning of a more sophisticated phase of financial risk?

Yona brings a decade of experience covering gaming, tech, and blockchain news. As one of the few women in crypto journalism, her mission is to demystify complex technical subjects for a wider audience. Her work blends professional insight with engaging narratives, aiming to educate and entertain.