The moonshot didn’t happen. Bitcoin ended 2025 at $87k–$90k range, missing the $150,000 targets retail traders were banking on. Wall Street isn’t crying about it. For the strategists at BlackRock and Coinbase, the rally was a secondary detail. They spent the year building out the plumbing. That professional-grade architecture is now finished. The frontier is officially settled.

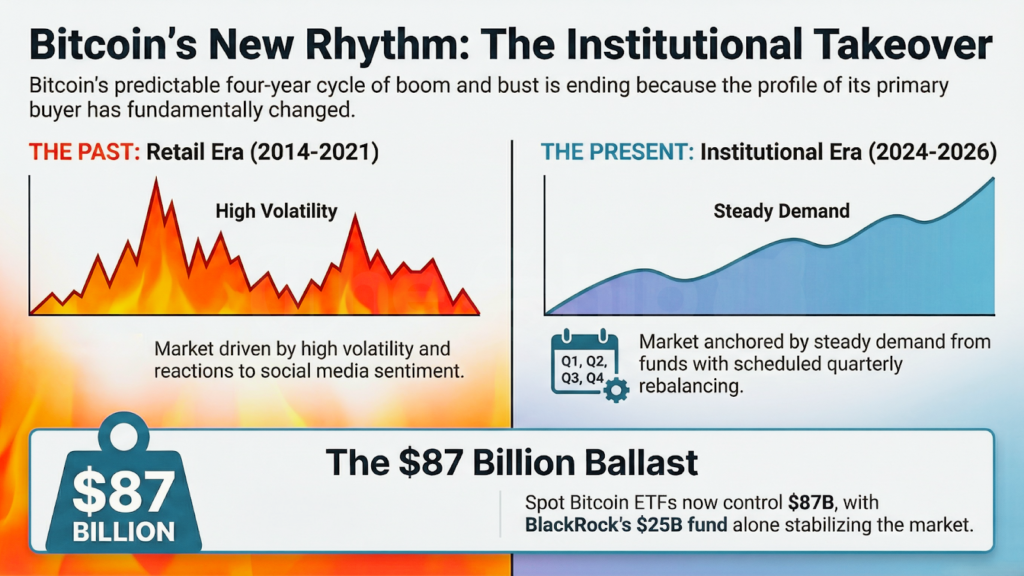

Bitcoin price action followed a reliable script for over a decade. That pattern of halving-induced rallies and crashes is breaking because the buyer profile has shifted. Grayscale Research indicates that 2026 will accelerate structural shifts in digital asset investing.

“We expect 2026 to accelerate structural shifts in digital asset investing, which have been underpinned by two major themes: macro demand for alternative stores of value and improved regulatory clarity,” Grayscale wrote in its December outlook. “As a result, we expect rising valuations in 2026 and the end of the so-called ‘four-year cycle.'”

The primary driver is the spot Bitcoin ETF market. It now holds $87 billion in assets. BlackRock’s fund alone controls $25 billion.

These vehicles are utilized by pension funds and endowments that rebalance quarterly. They do not react to social media sentiment.

This creates steady demand patterns that differ from the volatility driven by retail traders.

Matthew Sigel at VanEck suggests the cycle is evolving rather than vanishing. “Bitcoin’s historical four-year cycle, which tends to peak in the immediate post-election window, remains intact following the early October 2025 high,” Sigel wrotе in his 2026 outlook. “That pattern suggests 2026 is more likely a consolidation year than a melt-up or a collapse.”

While ETFs garner the headlines, derivatives markets now set the price. Research from Coinbase Institutional indicates that perpetual futures account for the majority of trading volume.

“This has shifted the mechanics of price formation toward positioning, funding rates, and liquidity conditions, rather than relying solely on retail-driven momentum,” David Duong and Colin Basco of Coinbase wrote.

The market saw a structural reset in late 2025. Massive amounts of leverage were flushed from the system via liquidation cascades.

VanEck reports that realized volatility has dropped by roughly half compared to previous cycles. This lower volatility aрpeals to institutional allocators. Pension funds are entering the market because prices no longer swing 20 percent on a rumor.

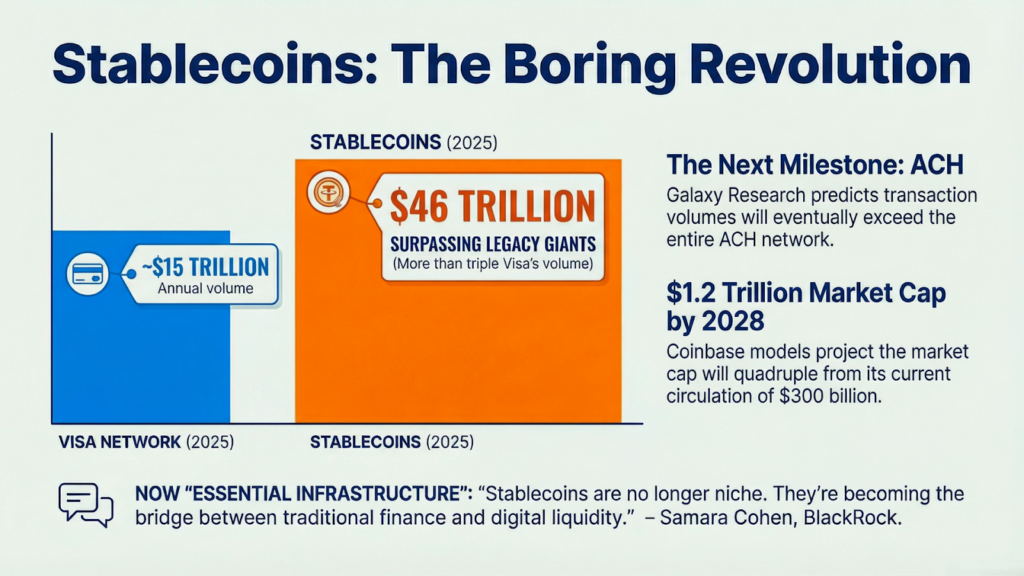

The real story in 2026 is the movement of money. Stablecoins processed $46 trillion in transactions during 2025.

Total circulation hit $300 billion. Samara Cohеn at BlackRock has stopped calling them crypto assets. She now frames them as essential infrаstructure.

“Stablecoins are no longer niche. They’re becoming the bridge between traditional finance and digital liquidity,” Cohen stated.

Related: The AI Paper

Regulatory clarity is accelerating this shift. The GENIUS Act passed in July 2025 provided a legal definition for stablecoins for the first time.

The law requires 1:1 backing and monthly audits. With final rules set to take effect in July 2026, enterprise usе cases are expanding.

Jeremy Zhang at a16z crypto predicts stablecoins will become the foundational settlement layer for the internet.

Coinbase models suggest the stablecoin market caр could reach $1.2 trillion by 2028. Galaxy Research predicts transaction volumes will eventually exceed the entire ACH network.

Stablecoins function regardless of whether Bitcoin is in a bull or bear market. This makes them infrastructure instead of speculation.

Tokenization is moving beyond the experimental phase. Nearly $20 billion in assets currently exist on blockchains.

BlackRock’s BUIDL fund has led this growth by tokenizing U.S. Treasury securities. The pitch is operational efficiency through 24/7 trading and instant settlement.

A key regulatory catalyst occurred in December 2025. The OCC conditionally approved national trust bank charters for five digital asset firms including BitGo, Circle, and Ripple. Stablecoin and custody infrastructure moved inside the federal banking system.

Galaxy Research predicts that in 2026, at least one major bank will accept tokenized stocks as collateral. They will treat them identically to traditional securities. SVB analysts expect tokenization to expand into private markets and consumer applications throughout the year.

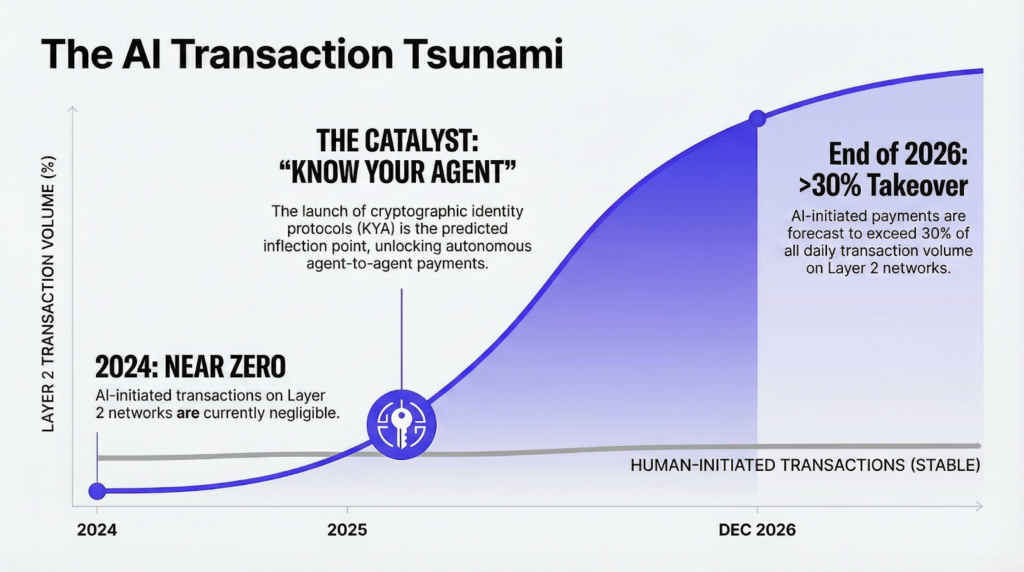

A radical prediction for 2026 involves the intersection of AI and blockchain. The firm a16z crypto argues that AI agents require crypto rails to function at scale. Traditional payment networks cannot process millions of microtransactions economically.

“For every human in financial services, agents now outnumber workers nearly 100 to 1,” a16z wrote in their outlook. “However, these autonomous systems still lack identity, permissions, or compliance structures.”

Related: Decentralized AI: Tech’s Biggest Leap—Or Its Next Big Mistake?

The firm predicts 2026 will see the introduction of Know Your Agent protocols. This cryptographic identity system links AI agents to liabilities and constraints.

It enables programmable settlement where agents pay each other for data or API calls instantly. Galaxy Research forecasts that AI-initiated payments could account for over 30% of daily transaction volume on Layer 2 networks like Base by the end of 2026.

The pace of crypto ETF launches has accelerated. Over 125 filings await approval as of late 2025. Galaxy Research projects more than 100 new crypto ETFs launching in 2026. Net inflows could exceed $50 billion.

Simultaneously, M&A activity is hitting all-time highs. Morе than 140 VC-backed crypto companies were acquired in 2025. Notable deals included Coinbase’s $2.9 billion acquisition of Deribit and Kraken’s purchase of NinjaTrader.

“As digital asset capabilities become table stakes for financial services, incumbents are accelerating acquisition strategies,” SVB wrote in its outlook.

Galaxy Researсh expects several crypto companiеs to pursue U.S. public listings in 2026. BitGo, Chainalysis, and FalconX are potential candidates. This public market access validates crypto business models to traditional finance.

Institutional adoption is being accelerated by macroeconomic fragility. BlackRock analysts cite the $38 trillion U.S. federal debt as a reason for the failure of traditional hedges. They view Bitcoin as a scarce digital commodity that serves as portfolio ballast.

VanEck’s David Schassler expects gold to reach $5,000 per ounce in 2026. This could drag Bitcoin higher as a correlated hedge. Grayscale expects bipartisan market structure legislation to become law in 2026. This would facilitate regulated trading of digital asset securities.

The operating environment has stabilized. Most SEC investigations into leading firms were resolved or withdrawn by late 2025. Austin Campbell, a professor at NYU Stern, notes that banks are now realizing that fighting stablecoins is like fighting the internet. A vanguard of banks will begin to adopt them in 2026.

The institutional outlook for 2026 is one of disciplined growth. VanEck explicitly frames it as a consolidation year. Most forecasts avoid predicting explosive mania. They instead focus on infrastructure development and capital base broadening.

“2026 won’t be about hype or memes,” wrote Paul Veradittakit of Pantera Capital. “It will be about consolidation, real compliance, and the movement of institutional money, driven by public market liquidity.”

As we watch the radical experiment become a global standard, onе question remains. Would Satoshi Nakamoto be happy about this?

The answer depends on your perspective. You might see the entry of BlackRock and the OCC as the ultimate validation of Bitcoin’s resilience. It is the moment the network became too big to fail.

You might seе the professionalization of the industry as the final subversion of its original intent. The peer-to-peer revolution has been wrapped in a corporate ETF.

Whether this represents a compromise or a victory is a question only time can answer.

2026 will be remembered as the year the frontier was finally closed if those predictions hold true. The radical experiment is now the foundation of the world it aimed to replace.

Yona brings a decade of experience covering gaming, tech, and blockchain news. As one of the few women in crypto journalism, her mission is to demystify complex technical subjects for a wider audience. Her work blends professional insight with engaging narratives, aiming to educate and entertain.

You cannot copy content of this page