The Shibarium Bridge for BONE token transfers has returned stronger than before, but not without introducing a new kind of price. This time, the cost is measured not in tokens, but in time. Shiba Inu’s developers have rolled out a reinforced bridge structure that adds a seven-day delay to withdrawal finalizations, a deliberate trade-off between liquidity and long-term security.

In Brief

For many in the Shiba Inu ecosystem, this marks a turning point in the network’s evolution. The decision to slow down bridge transfers is not an accident or a limitation. It is an expression of sovereignty — a statement that the ecosystem values the safety of user assets above all else.

The Shibarium Bridge is one of the network’s most critical gateways, allowing assets like Bone ShibaSwap (BONE) to move between Ethereum and Shibarium. In this latest upgrade, developers have introduced a seven-day finalization period on withdrawals. This design forces the system to hold and verify transactions across several checkpoints before they are fully released.

It may feel like a step back in convenience, but in the logic of decentralized infrastructure, time has become a tool for protection. Each day in that seven-day cycle gives the network and its validators an opportunity to observe, verify, and respond to potential threats before they manifest.

The delay converts time into a security layer, ensuring that liquidity cannot be exploited in a single instant.

The new mechanism, which has been audited by cybersecurity firm Hexens, also features a blacklisting function that can block malicious addresses from interacting with the bridge. Together, these safeguards transform Shibarium’s bridge into one of the most defended transfer systems in the ecosystem.

In traditional finance, speed equals efficiency. In decentralized finance, speed can also mean exposure.

The seven-day delay in the Shibarium Bridge represents a fundamental rethink of liquidity. It redefines it not as a constant flow but as a regulated pulse, one that beats slower but stronger.

Shiba Inu developer Kaal Dhairya described this shift as a move from “fast transfers” to “risk-free finality.” By placing value on time, the network essentially purchases security.

Each pending withdrawal represents a temporary liquidity cost, but one that assures long-term system integrity. This is the new price of sovereignty, the network’s ability to govern its own security without outsourcing it to centralized intermediaries.

From a broader economic standpoint, this choice is strategic. It signals to liquidity providers and institutional participants that Shibarium values stability over speed.

Related: SHIB 2025: The Year the Pack Refused to Break

For long-term investors, it is a reassuring message. The ecosystem is growing into a space where trust is built through structure, not hype.

Alongside the technical enhancements, the Shibarium team has implemented measures for accountability. The reactivation of the bridge follows a comprehensive testing cycle; from unit testing and simulation to full deployment on the Puppynet test network.

Only after passing all internal and external checks did it return to mainnet operations. The bridge has also been reinforced by community-focused programs like the KNINE bounty and the repayment initiative for users affected by earlier network incidents.

These steps show that Shibarium’s leadership is willing to take responsibility while simultaneously strengthening system resilience.

This posture of accountability is not common in decentralized projects. Many networks respond to crises with silence or deflection. Shiba Inu’s approach, however, has been one of reflection and re-engineering. The updated bridge is a direct product of that philosophy.

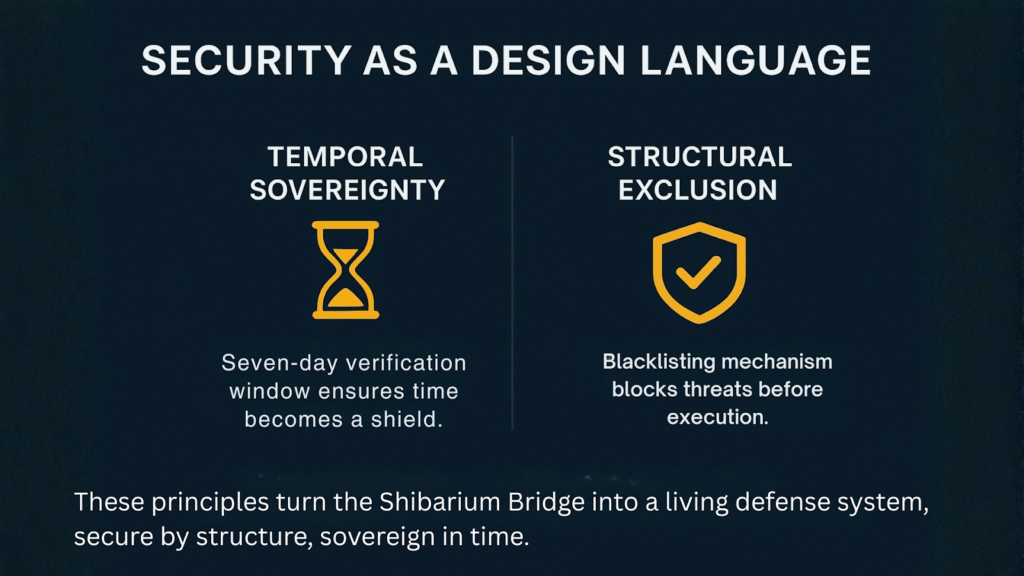

Two new principles define the architecture of the Shibarium Bridge: Temporal Sovereignty and Structural Exclusion.

Temporal Sovereignty: is the power to define one’s own rhythm of verification. The seven-day window is not just a waiting period but a declaration that the network moves on its own time, free from external pressure or centralized control.

Every withdrawal passes through this temporal gate, ensuring that all transactions are observed and validated thoroughly.

Structural Exclusion: meanwhile, is the ability to actively defend the system by blocking malicious entities. The new blacklisting mechanism empowers the security team to remove harmful addresses before they can cause damage.

Related: Shiba Inu Suit-and-Tie Era Happening Now

It is a defensive layer that grows smarter with every incident, learning from patterns of abuse and adapting to new threats.

Together, these principles form the foundation of the new Shibarium Bridge. The system is no longer just a transfer route; it is a living defense mechanism, designed to evolve as the ecosystem grows.

When the Shibarium bridge went offline for review and security enhancements, many questioned the future of liquidity in Shibarium. Its return, however, has shown that the pause was not a setback but a preparation for scale.

The enhanced bridge demonstrates that decentralization is not just about removing intermediaries, it is about distributing responsibility intelligently.

The Shibarium Bridge now embodies a philosophy where every trade-off is intentional. The liquidity cost is not a penalty but an investment in collective assurance. It is an act of maturity for a network that continues to grow in both size and purpose.

In an ecosystem where volatility and exploits often define the narrative, Shiba Inu’s decision to slow down rather than rush ahead is quietly revolutionary. It acknowledges that sustainable decentralization requires patience.

The network is, in effect, teaching its participants that time can be the most powerful currency of all.

With its new mechanisms, Temporal Sovereignty, Structural Exclusion, and Vetted Verification, the Shibarium Bridge represents a modern model of decentralized liquidity. It treats verification not as a checkpoint but as a covenant between the network and its users.

In this architecture, time equals trust. Each day in the verification cycle strengthens the bond between users and validators, reinforcing that Shibarium’s bridge is more than a conduit for assets. It is a living proof of the ecosystem’s resilience and design discipline.

The seven-day waiting period is not a delay to be endured. It is a signal of independence, proof that the Shiba Inu ecosystem now defines the rules of its own economy.

In this system, time is no longer wasted. It is invested. The new liquidity cost is, in truth, the price of sovereignty.

Yona brings a decade of experience covering gaming, tech, and blockchain news. As one of the few women in crypto journalism, her mission is to demystify complex technical subjects for a wider audience. Her work blends professional insight with engaging narratives, aiming to educate and entertain.