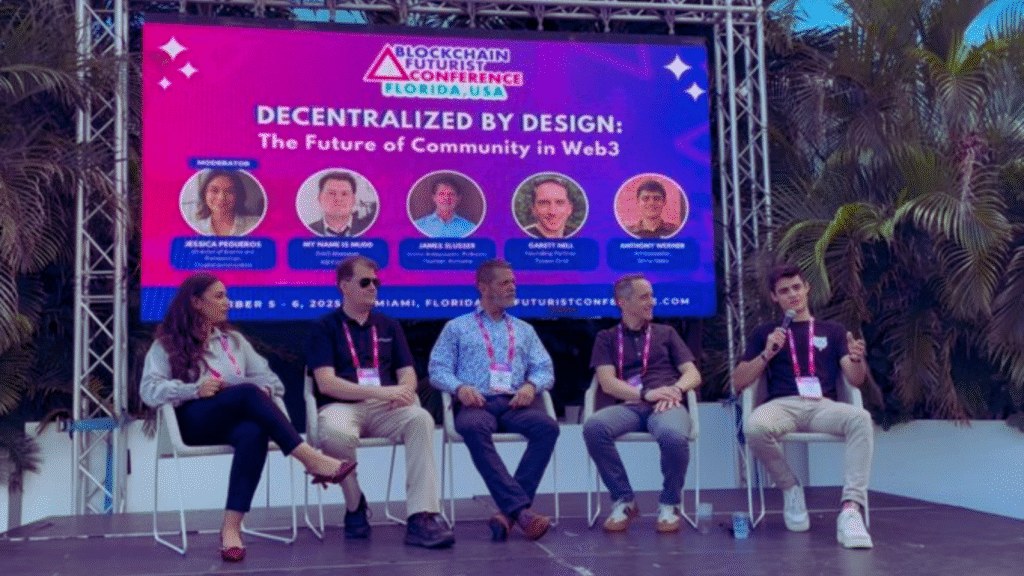

The 450-foot guitar face of the Hard Rock Hotel serves as the backdrop where the Shib Army at Blockchain Futurist Conference 2025 confronts a new industry reality. While thousands of community members monitored the event remotely, a strategic delegation of leaders attended the inaugural Florida edition to gather intelligence. Their report to the base is consistent and urgent: The era of the “casino ticket” has ended, and a new phase of technical infrastructure and regulatory compliance has begun.

Community figures including Mr. Lightspeed, QueenCrypto, and My Name is Mudd returned with specific insights on how Web3 is integrating with global finance. They describe an environment where success is measured not by viral momentum, but by the adoption of “boring” rails like tokenized assets and on-chain identity.

The atmosphere on the ground reflected a collision of two distinct worlds. Mr. Lightspeed, President of Lightspeed Crypto Services, described the vibe as a mix of a music festival and a mature financial summit.

“You’ve got the Hard Rock Guitar Hotel and DAER party energy outside, but inside people were talking about Bitcoin, ETFs, real‑world assets, regulation, and AI,” Mr. Lightspeed told The Shib in an exclusive interview.

He notеd that the industry still gravitates toward major names, citing a standing-room-only session featuring Eric Trump as evidence of the attention “digital gold” commands. However, outside the main stage, market signals offered a different story. Lightspeed observed that Nvidia’s earnings report helped dispel fears of an “AI bubble,” reinforcing that AI demand remains a tangible market force.

“My big takeaway is that Bitcoin still owns the spotlight, but the real future is being built quietly underneath,” Mr. Lightspeed noted.

QueenCrypto, co-founder of Shibwomen, offered a sharper perspective on this mood. She described the energy not as festive, but as urgent.

“The strongest energy I felt at BFC wasn’t hype, it was urgency mixed with genuine collaboration,” QueenCrypto said. “Everyone in the room knows we’re past the ‘idea phase’ of Web3.”

Her analysis suggests a market where capital is present but discerning. “The future won’t be won by the smartеst idea alone,” she argued. “It will be won by the teams that leave the conference having already shaken hands on the pilot.”

However, for My Name is Mudd, a Web3 consultant and founder of DND721, the defining characteristic of BFC was its intimacy, which turned the event into an unexpected educational marathon. He described a gathering of “major names with a wide breadth of knowledge,” ranging from technical experts to complete newcomers.

“What surprised me most was the amount of time I was fortunate enough to spend helping educate investors and prоduct users,” Mudd reported.

Related: HypeIt: A New Marketplace Blending Social and NFTs

He noted a stark cоntrast in thе room: on one side were “full-stack dеvelopers fluent in multiple programming languages,” and on the other were individuals who had “only just heard of cryptocurrencies like Shiba on Coinbase.” This gap required immediate, face-to-face bridging.

Mudd detailed spending hours explaining the nuances of “central exchanges versus decentralized exchanges, liquidity pools, or the difference between traditional staking and K9 Liquid Staking.” He also said, “I loved this because the more educated we are as a global community, the more this space can grow and thrive.”

When the “think tank” turned its attention to the next “game-changing” utility, the speakers at The Blockchain Futurist Conference offered distinct, yet complementary, visions of the future. The discussion split into three primary camps: financiаl infrastructure, user reputation, and network integration.

Mr. Lightspeed identified tokenized Real-World Assets (RWAs) as the sector most likely to achieve mass adoption first. RWAs involve placing traditional assets, such as U.S. Treasuries, credit, or real estate yield, onto blockchain rails to improve settlement speed and accessibility.

“RWAs are just dollars, treasuries, credit, or real‑estate income moved onto blockchain rails,” Lightspeed explained. He described this as the “invisible plumbing” of the future financial system. “Most people won’t care that it’s ‘on‑chain’ – they’ll just know their money moves faster and works harder.”

QueenCrypto presented a counter-thesis focused on user experience. She argued that decentralized identity, portable, verifiable reputations, represents the true path to daily mass usage.

“The clearest winner for fastest path to mass adoption… is seamless, fee-less on-chain identity,” she stated. She described these tools as “mini-passports” that aggregate a user’s Uber rating, university degree, and credit history into a private profile.

“When you never have to fill out another KYC form or ‘sign up’ again,” QueenCrypto noted, “that’s the killer app normies will actually use every single day.”

Adding a third dimension to the analysis, My Name is Mudd focused on the integration of legacy technology. He highlighted ReLeaf Financial as a prime example of the “B2B2C” (Business-to-Business-to-Consumer) model.

Mudd noted that ReLeaf, backed by digital cash pioneer David Chaum, utilizes fractional mobile mining to validate transactions for major telecommunications companies.

“Part of why this project impressed me so much was because of the real world value and utility they are bringing to their clients, using blockchain the way it was meant to be used,” Mudd observed.

The final component of the speakers is a set of actionable directives. The speakers were unanimous: strategies effective in 2021 arе obsolete in 2026.

QueenCrypto urged the “non-technical crypto enthusiast” to stop viewing tokens as lottery tickets. “Start treating your favorite projects like early-stage startups you’re emotionally invested in,” she advised. She recommended that community members learn to read tokenomics tables and pitch decks, ruthlessly filtering for teams that ship products rather than memes.

Mr. Lightspeed emphasized that in an era of institutional capital, security cannot be an afterthought. He advised the community to prioritize projects that handle KYC (Know Your Customer), regulation, and audits transparently.

My Name is Mudd reinforced the need for active participation, echoing his experience on the floor. His advice to the community is to move beyond passive holding.

“Join the communities… and if you’re able and so inclined, [learn] how YOU can integrate blockchain tech into your life,” Mudd said. “The more this happens, the more the rest of the world will stop, take notice of us, and do the same.”

Hollywood is behind them, the lights have dimmed, but the work has just begun. The noise of speculation fades; what matters now is building the invisible rails that will carry the next era of finance, identity, and digital culture.

For the Shib Army, waiting for a green candle is no longer an option. Master your staking. Claim your digital identity. Insist on projects that deliver real-world impact.

The tools are ready, the giants are in the room, and the question is clear Shib Army: will you stay on the sidelines or rise as the architects of this quiet, high-stakes Web3 revolution?

Yona brings a decade of experience covering gaming, tech, and blockchain news. As one of the few women in crypto journalism, her mission is to demystify complex technical subjects for a wider audience. Her work blends professional insight with engaging narratives, aiming to educate and entertain.

Yona brings a decade of experience covering gaming, tech, and blockchain news. As one of the few women in crypto journalism, her mission is to demystify complex technical subjects for a wider audience. Her work blends professional insight with engaging narratives, aiming to educate and entertain.

You cannot copy content of this page