On Christmas Eve, Shiba Inu traded at $0.0000073, down more than two-thirds from its spring highs, buried under the same avalanche that crushed most retail-driven tokens. Yet in the very same year, a filing landed on the SEC’s desk from T. Rowe Price thаt listed SHIB alongside Bitcoin in a proposed Wall Street ETF, Japanese regulators stamped it onto their exclusive Green List, and Grayscale formally classified it as a core “Consumer & Culture” asset. The contrast was stark: while screens flashed red, the infrastructure of lasting legitimacy was being poured in steel and concrete.

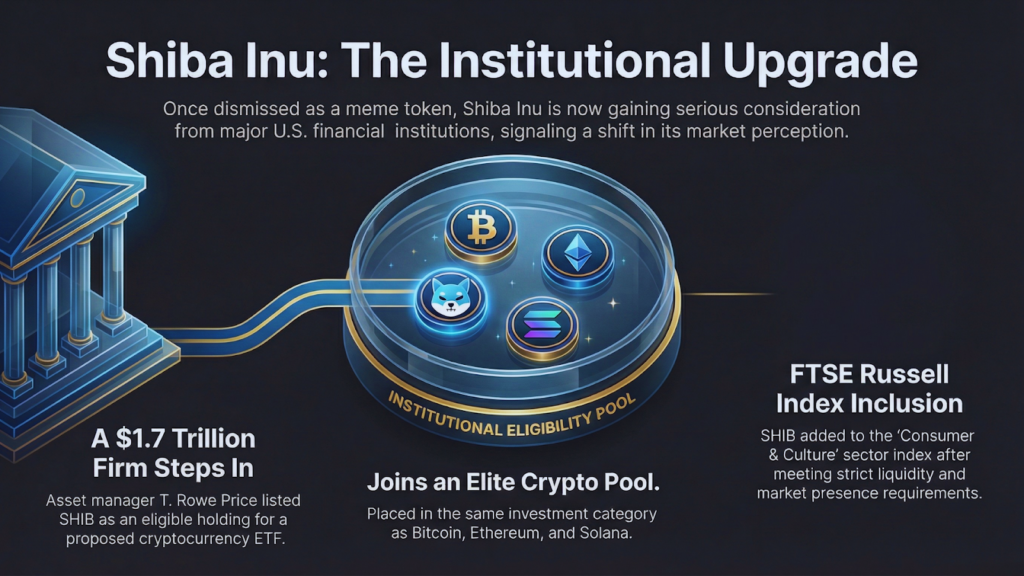

In October, T. Rowe Price, overseeing more than $1.7 trillion in assets, submitted a registration statement for an actively managed cryptocurrency exchange-traded fund. The prospectus named Shiba Inu among eligible holdings, placing the once-dismissed meme token in the same breath as Bitcoin, Ethereum, and Solana.

The proposed fund’s active strategy allows manаgers to increase or trim SHIB exposure based on liquidity, momentum, and on-chain metrics. This marked the first time a major U.S. asset manager treated a community-born token as a serious, adjustable allocation rather than a speculative sideshow.

Grayscale Investments added weight through its partnership with FTSE Russell. In its October 2025 report, Shiba Inu secured placement in the Consumer & Culture sector, an index category it shares only with Dogecoin, after satisfying strict liquidity and market-presence thresholds. This classification acknowledges the token’s roots in digital community building and entertainment.

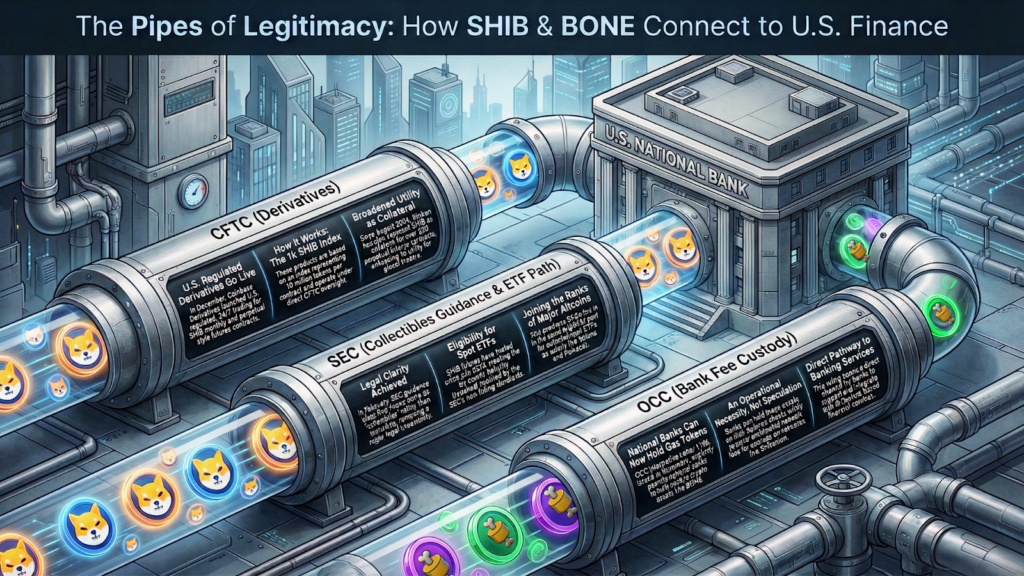

February’s SEC guidancе classifying meme coins as collectibles rather than securities cleared lingering legal clouds.

The year’s most concrete derivatives milestone arrived in December when Coinbase Derivatives fully activated U.S.-regulated access. On December 5, 24/7 trading went live for monthly futures, followed by the launch of perpetual-style contracts for SHIB and other altcoins.

These products, based on the 1k SHIB Index (representing 10 million tokens per contract and tied to a benchmark rate), operate under CFTC oversight through approved intermediaries, providing institutions and retail traders compliant leverage and continuous exposure.

Related: The Hardest Reset: One Developer’s War To Save Shib

Earlier foundations supported this expansion: CFTC-regulated SHIB futures had traded on Coinbase since July 2024, exceeding the six-month threshold required under the SEC’s new generic listing standards approved in September 2025. This maturity positions Shiba Inu squarely in the eligibility pool for pоtential spot ETFs, alongside assets like Solana and Polkadot.

Kraken further elevated SHIB’s utility by accepting it as collateral for over 200 perpetual futures contracts since August 2024, allowing global traders to leverage holdings directly from spot wallets.

November delivered another layer of banking integration when the Office of the Comptroller of the Currency issued Interpretive Letter 1186. This guidance explicitly permits national banks to hold volatile crypto-assets, including gas tokens like BONE for Shibarium, in limited amounts on their balance sheets solely to cover anticipated network fees for permissible activities. By treating these holdings as operational necessities rather than speculative investments, the ruling opens direct pathways for banks to support Shibarium-based services.

Related: Shiba Inu Enters New Regulated Waters: Banks Trades, Courts Protect

November brought official confirmation: the Japan Virtual and Crypto Assets Exchange Association added Shiba Inu to its Green List, making it one of the first meme-origin tokens to pass the country’s rigorous vetting for transparency and operational stability.

The designation opens seamless trading across every licensed Japanese exchange and positions SHIB to benefit from proposed tax reforms that would slash capital-gains rates on approved assets to a flat 20%.

Valour continued to offer its Swedish krona-denominated Shiba Inu ETP on the Spotlight Stock Market, рroviding European investors regulated access through ordinary brokerage accounts under the continent’s evolving MiCA framework.

The year’s price collapse reflected familiar forces: fading retail hype, competition from newer narratives, and macro headwinds across risk assets. Yet the institutional and regulatory milestones arrived precisely during this downturn, a pattern seen in earlier cycles where foundational progress often builds quietly before sentiment turns.

As 2025 ends, the ecosystem stands at an inflection point: battered in price, but fortified with approvals and products that once seemed unthinkable. The question now is straightforward: when market winds shift again, will the infrastructure built in the cold prove strong enough to carry Shiba Inu into its next chapter?

Yona brings a decade of experience covering gaming, tech, and blockchain news. As one of the few women in crypto journalism, her mission is to demystify complex technical subjects for a wider audience. Her work blends professional insight with engaging narratives, aiming to educate and entertain.

You cannot copy content of this page