It didn’t happen overnight—but when it happened, it was undeniable.

In 2025, the question is no longer whether institutions will enter crypto. It’s how deeply they intend to stay.

For years, digital assets flirted with legitimacy, their prices pulled upward by retail surges and speculative froth. But something changed.

The pace quickened. The players shifted. What we’re seeing now isn’t hype—it’s reallocation, realignment, and, increasingly, restructuring.

Across boardrooms and trading desks, whether in the towers of BlackRock or at the desks of lean venture firms, the tone has changed. Bitcoin has outgrown its reputation as a risky bet. Today, it’s seen as a hedge, a reserve, even a statement.

Ethereum, too, has evolved. It now underpins much of the emerging digital financial stack, quietly powering contracts, apps, and protocols.

And the balance sheets of publicly listed companies, global banks, and sovereign wealth funds are beginning to reflect that shift.

We have entered Institutional Adoption 2.0—a chapter defined less by curiosity and more by conviction.

Crypto has always had whales, those anonymous titans whose trades send tremors through the markets. But the whales of 2025 are different. They wear suits. They answer to boards. And they’re not in it for the thrill—they’re in it for the long haul.

In the first half of the year, over 80,000 BTC—valued then at nearly $8.7 billion—moved from dormant 2011-era wallets. Analysts don’t view it as a liquidation. They see rotation: old money out, structured capital in. A generational shift in custody.

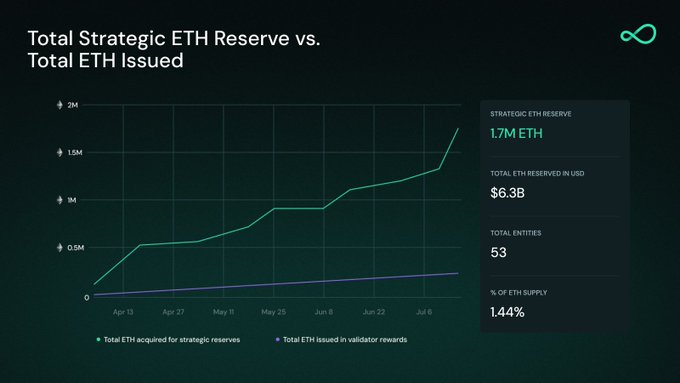

Ethereum, too, is seeing accumulation—not just among early adopters or DeFi veterans, but from funds treating ETH as a strategic asset. Wallets tied to institutional desks have quietly absorbed more than 250,000 ETH since June. Simultaneously, the number of active ETH addresses is on the rise. The implication: utility and speculation are beginning to converge.

GSR’s $100 million deployment into crypto treasuries is a signal. So is the behavior of sovereign wealth funds rumored to be diversifying into digital commodities. These are not casual plays. These are foundation stones.

If institutional wallets are the hidden movers, ETFs are the public gatekeepers.

Since their launch in 2024, U.S. spot crypto ETFs have become the Trojan horses of digital adoption, offering compliance-wrapped exposure to asset managers, retirement portfolios, and wealth advisors. In 2025 alone, they’ve brought in $14.8 billion, pushing cumulative flows beyond $52 billion.

The trend shows no signs of slowing. Ethereum ETFs, still young, attracted over $3.2 billion in July alone. And by mid-year, total crypto assets under management globally surpassed $180 billion.

“This is just the beginning,” said Hunter Horsley, CEO of Bitwise, noting that even conservative banks have approved crypto ETFs for client portfolios. “Advisors no longer have to apologize for allocating digital assets.”

Cathie Wood, of ARK Invest, sees a longer arc. Her firm projects that Bitcoin could hit $2.4 million by 2030, fueled in large part by ETF accessibility.

Perhaps the most quietly transformative development is happening not on exchanges, but on spreadsheets.

Companies are buying crypto. Not for experimentation—but for strategy.

MicroStrategy may have been first, but it is no longer alone. In 2025, public firms added nearly 238,000 BTC to their treasuries—twice the volume acquired by ETFs during the same period.

Many did so quietly. But the scale is telling.

“This isn’t about trading,” said David Duong, head of institutional research at Coinbase. “It’s balance sheet engineering.”

Beyond Bitcoin, U.S. and Canadian corporations have begun acquiring ETH at scale—adding over $840 million worth to treasuries this year. These decisions are often framed as long-term hedges against fiat debasement or bets on decentralized infrastructure.

As Ciara Sun of C Squared VC put it: “Bitcoin is morphing from a tradeable chip into a treasury asset.”

This flood of capital has brought with it stability and attention—but not immunity.

Markets remain volatile. Regulation is uneven.

Hacks and governance controversies still make headlines. Yet the tone of the industry is shifting—from defiance to discipline.

A recent EY survey found that 83% of institutional investors plan to increase their crypto allocations in the next 12 months. Global crypto ownership has surpassed 650 million people. In quiet, persistent ways, digital assets are embedding themselves into the wiring of global finance.

This isn’t the end of a movement. It’s the beginning of an era.

Institutions aren’t just buying—they’re shaping. And as the contours of global finance bend around crypto, builders, investors, and communities must ask: what role will we play in the world they are helping to define?

For ecosystems like Shiba Inu, the message is clear. This is no longer a sideshow. This is a main event.

And those who prepare—not only for the next pump, but for the next 10 years—will write the rules of this new financial order.