The geopolitical crypto crash: Iran–Israel, driven by airstrikes, oil threats, and military posturing, has taken several dramatic turns. After nearly two weeks of escalating conflict, U.S. President Donald J. Trump dropped a “Complete and Total CEASEFIRE” — and within minutes, the crypto markets flipped from panic to euphoria. Bitcoin ripped. Ethereum surged. Traders rushed back in.

What looked like the start of a recovery now rests in uneasy stillness.

New revelations have complicated the narrative. Trump’s ceasefire announcement was preceded by U.S. strikes on Iranian nuclear sites, followed bу Iran’s retaliation: a missile attack on a U.S. base in Qatar.

Since then, both Iran and Israel have committed to a ceasefire, brokered through Qatari and U.S. channels.

As of June 25, 2025, that ceаsefire appears to be holding.

The market may have bounced, but the forces behind this rally are anything but stable.

For days, the onlу direction was down. The geopolitical crypto crash: Iran-Israel had started with Israeli strikes, escalated with U.S. airstrikes on Iranian targets, and nearly imploded when Iran threatened to close the Strait of Hormuz—a move that could choke off 20% of global oil supply.

Then came Trump’s missile strike — a decision he later claimed “obliterated” Iran’s nuclear capabilities. But U.S. intelligence suggested otherwise: the program was merely set back by a few months. The Iranian government retaliated by hitting a U.S. base in Qatar, further escalating fears.

On June 23, Trump declared a ceasefire between Israel and Iran, with both sides agreeing not to strike unless provoked. The announcement, though lacking full verification, was enough to ignite a relief rally: Bitcoin broke $106,000, Ethereum touched $2,420. Market watchers noted a surge in FOMO-driven buying.

But that euphoria was tempered by doubt. Confirmation from Israel came late. Trump, meanwhile, oscillated between frustration and celebration. On June 24, he sharply criticized both sides, expressing frustration over what he described as aimless and chaotic fighting, especially following initial ceasefire violations.

Still, the ceasefire stuck — for now. A Trump envoу has indicated peace talks with Iran are “promising.”

Related: Casascius Coins 2025: $180M Bitcoin Suddenly Moves

This isn’t the first time crypto has snapped back after a geopolitical shock. Analysts recall similar bouncеs after previous conflicts, but what makes this different is the sheer speed of sentiment reversal — and how quickly narrative overrides fact.

Trump’s claim that Iran’s nuclear sites were “COMPLETELY DESTROYED!” on Truth Social stands at odds with intelligence reports. Political controversy erupted in Washington, with Democrats attempting but failing to initiate impeachment proceedings over the unannounced strikes.

Meanwhile, oil prices are inching higher. The Strait of Hormuz remains a key risk.

Any renewed threat there could force the Fed to reverse course on rate cuts — adding macro pressure to a still-shaky crypto market.

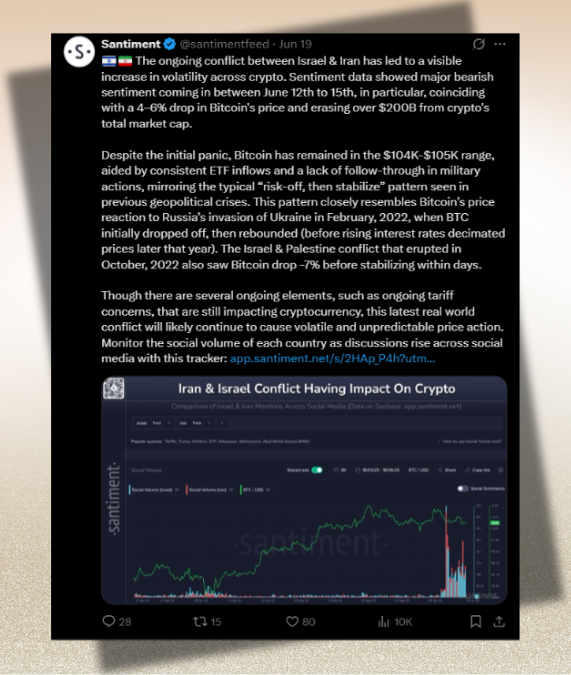

What makes this crypto crash fascinating is how fast sentiment flips. Just days earlier, Santiment had flagged “major beаrish sentiment,” with Bitcoin hovering between $104K and $105K, bolstered mostly by ETF inflows and hopes that global conflict wouldn’t get worse. Now, that same crowd flooded back in, lifting prices as though the last week hadn’t happened.

Related: Shiba Inu Delivers on Its Promise With New Bounty Contract

Anthony Pompliano’s often-quoted phrase — “Bitcoin is relentless” — suddenly looked prophetic again. But even Pompliano’s maximalism can’t paper over the reality: Bitcoin’s recent behavior looks more like a high-risk tech stock than “digital gold.” And that’s before factoring in Hormuz.

Because here’s the thing — the Hormuz threat hasn’t been officially withdrawn. JPMorgan analysts had already forecast that conflict-driven oil spikes could push prices to $120 a barrel. A closed Hormuz? That would blow up inflation forecasts and force the Fed to reconsider any plans for rate cuts.

Translаtion: This rally fеels good, but it’s balancing on a razоr’s edge.

As of June 25, the ceasefire has held longer than many expected. Trump has emphasized that he doesn’t seek regime change in Iran, citing the risk of “chaos.” That hints at a more diplomatic path forward, though tensions remain high.

The market, for now, is cautiously bullish. But investors know how quickly hope can vanish. One tweet. One drone. One escalation — and billions could evaporate.

The geopolitical crypto crash: Iran-Israel has delivered a masterclass in volatility. This sudden turn toward peace offers a glimpse of recovery, but the market’s foundation is still shaky. Until every key player signs on to this ceasefire — and until threats like Hormuz fade — the charts will remain haunted by what might happen next.

One tweet. One hesitation. One escalation. That’s all it takes to swing billions in value.

Crypto doesn’t float above global power struggles. It sinks or soars with them. The red ink on traders’ screens wasn’t just numbers — it was a brutal reminder of exactly that.

Yona brings a decade of experience covering gaming, tech, and blockchain news. As one of the few women in crypto journalism, her mission is to demystify complex technical subjects for a wider audience. Her work blends professional insight with engaging narratives, aiming to educate and entertain.

You cannot copy content of this page